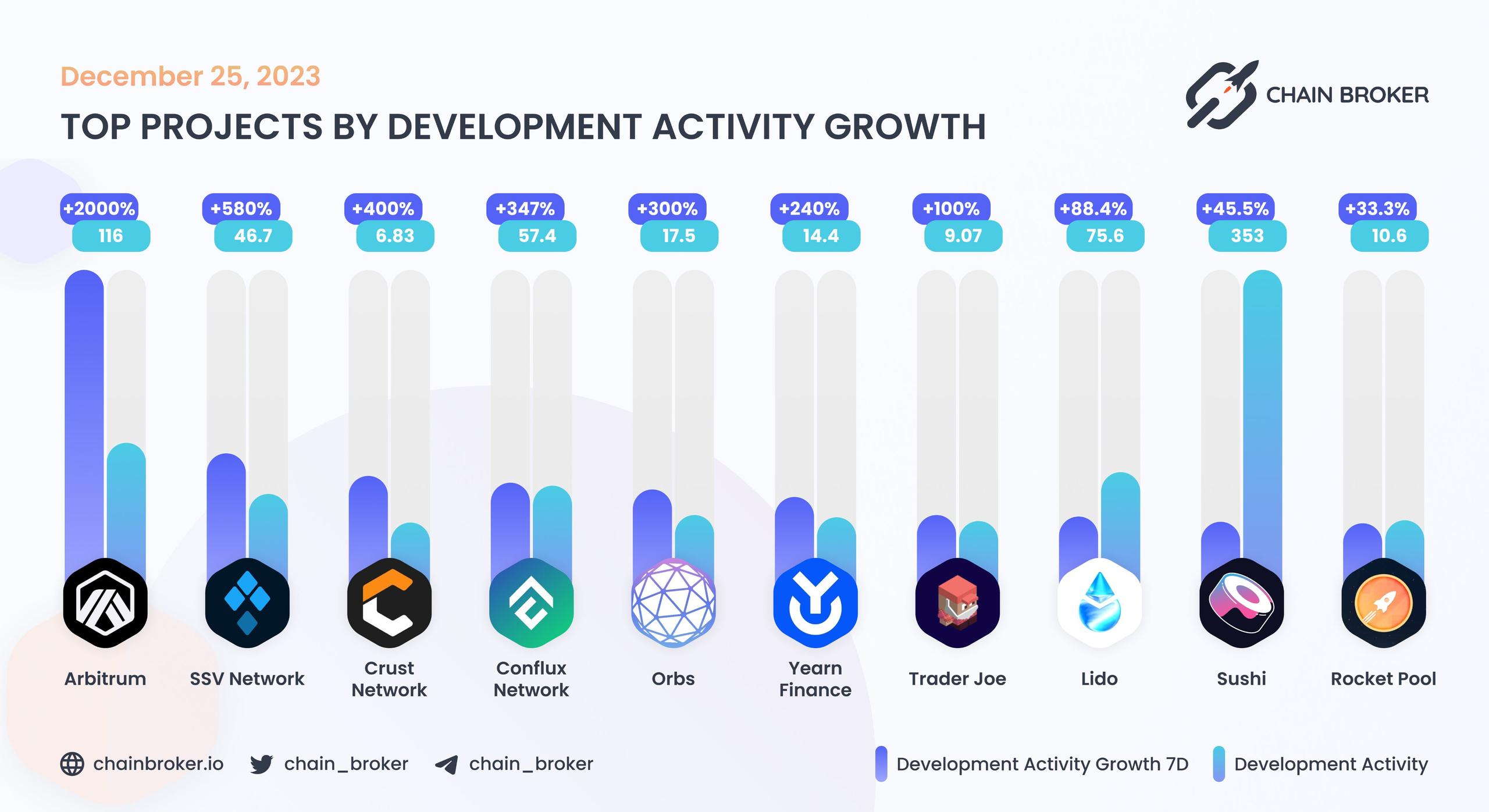

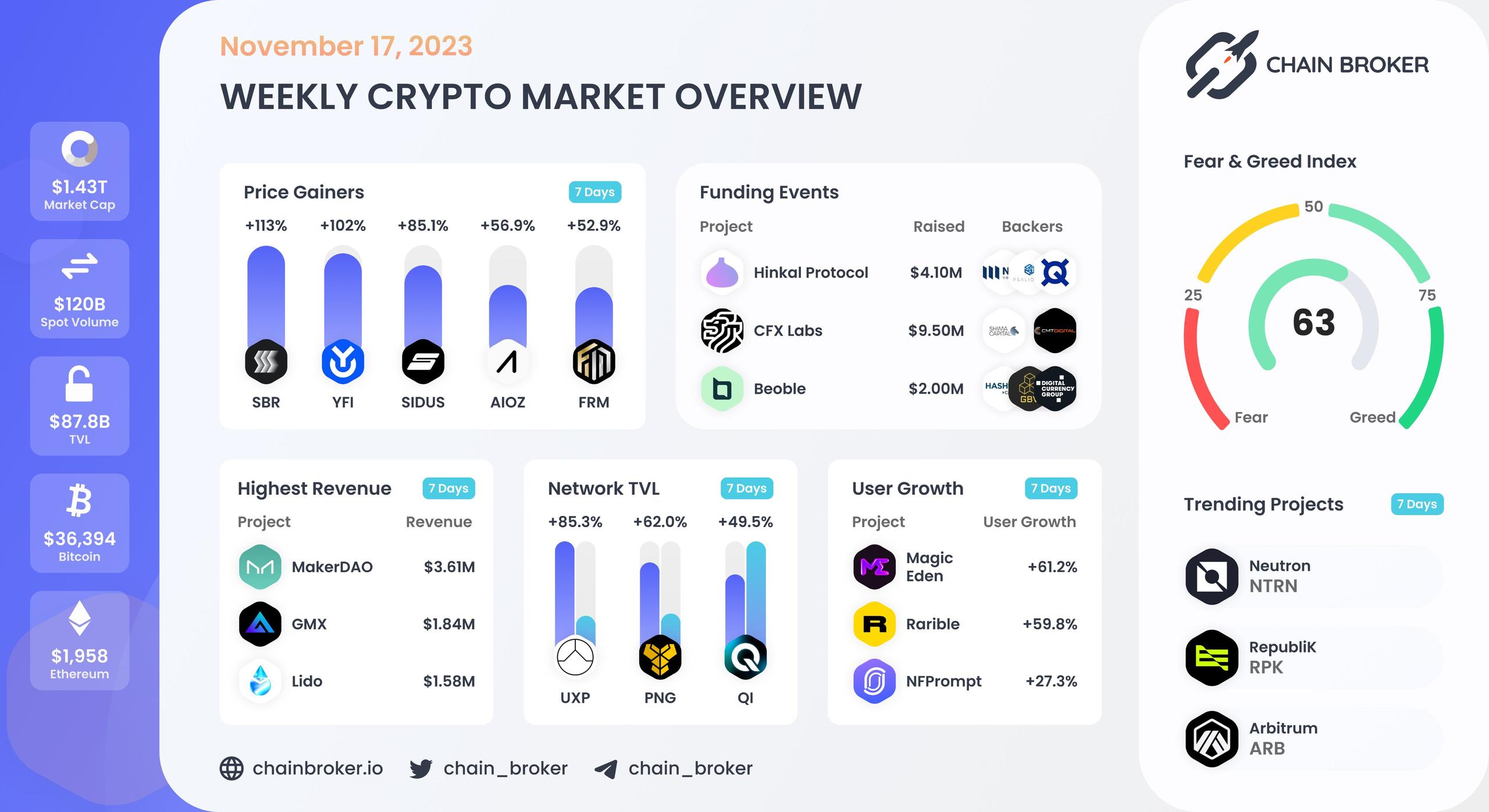

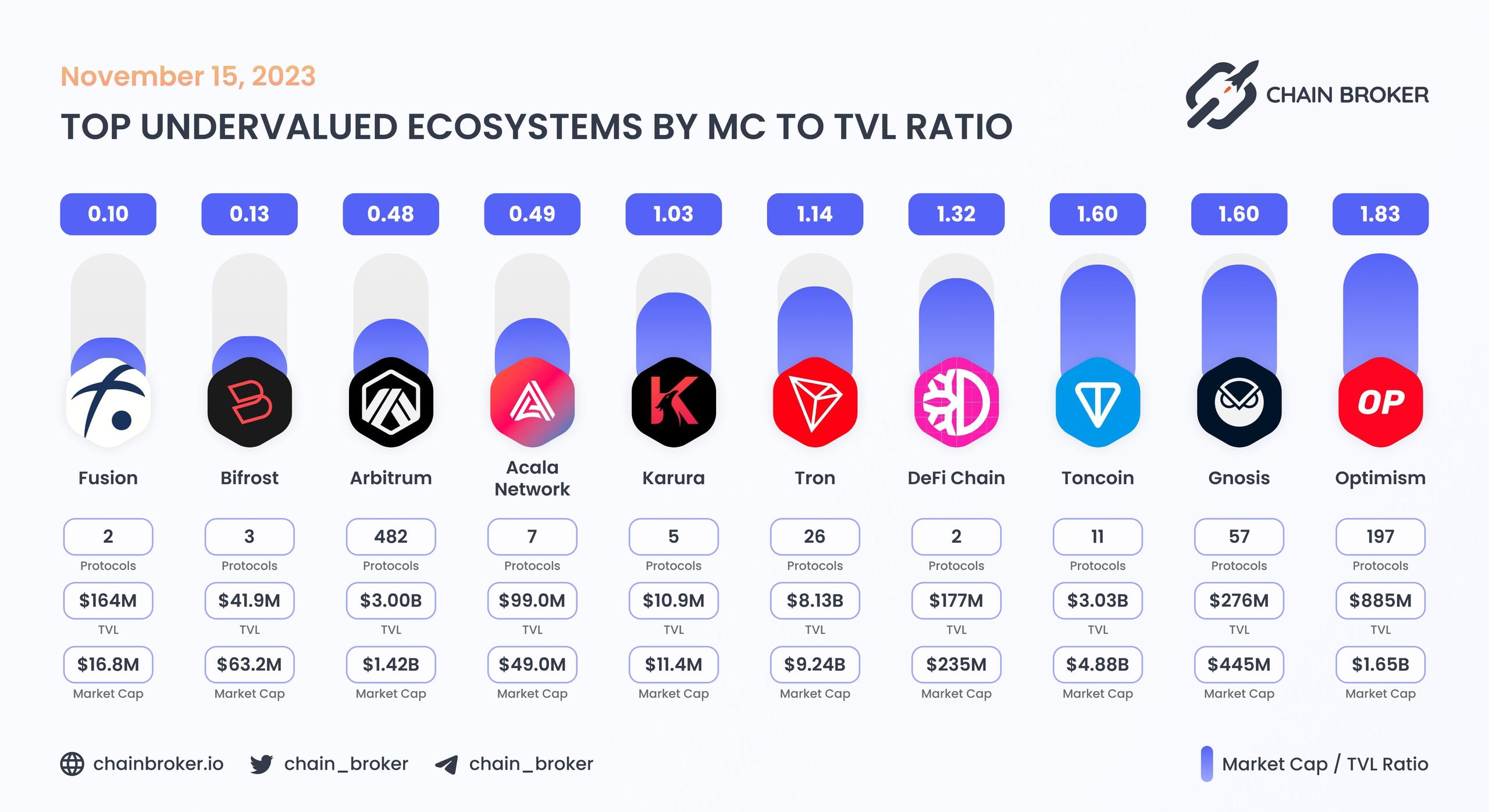

Arbitrum

ARBBrokerScore

ARB / USD Price Chart

Loading...

Loading...| Period | Change | Low | Bounce | High | Dip | Volatility | |

|---|---|---|---|---|---|---|---|

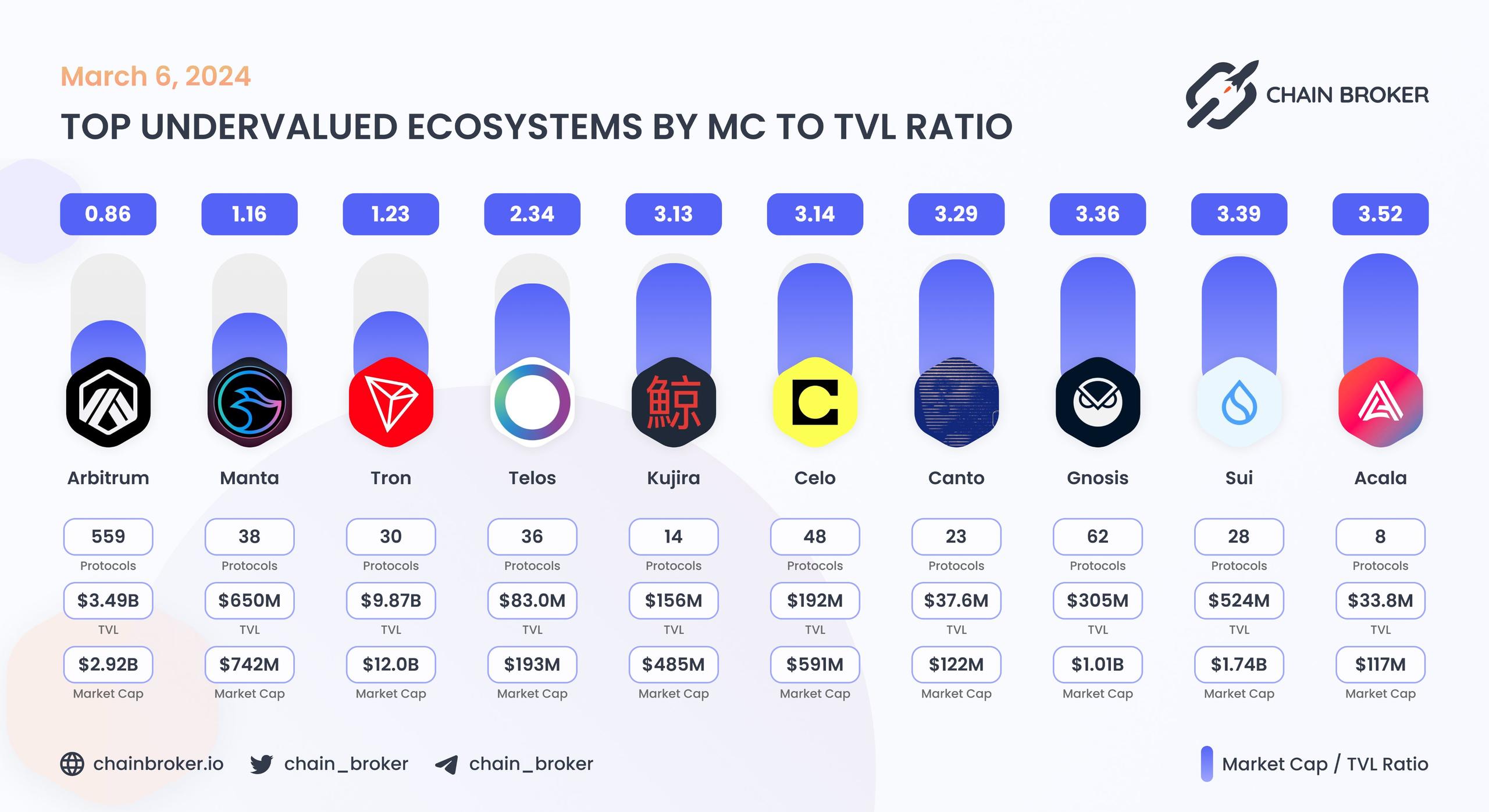

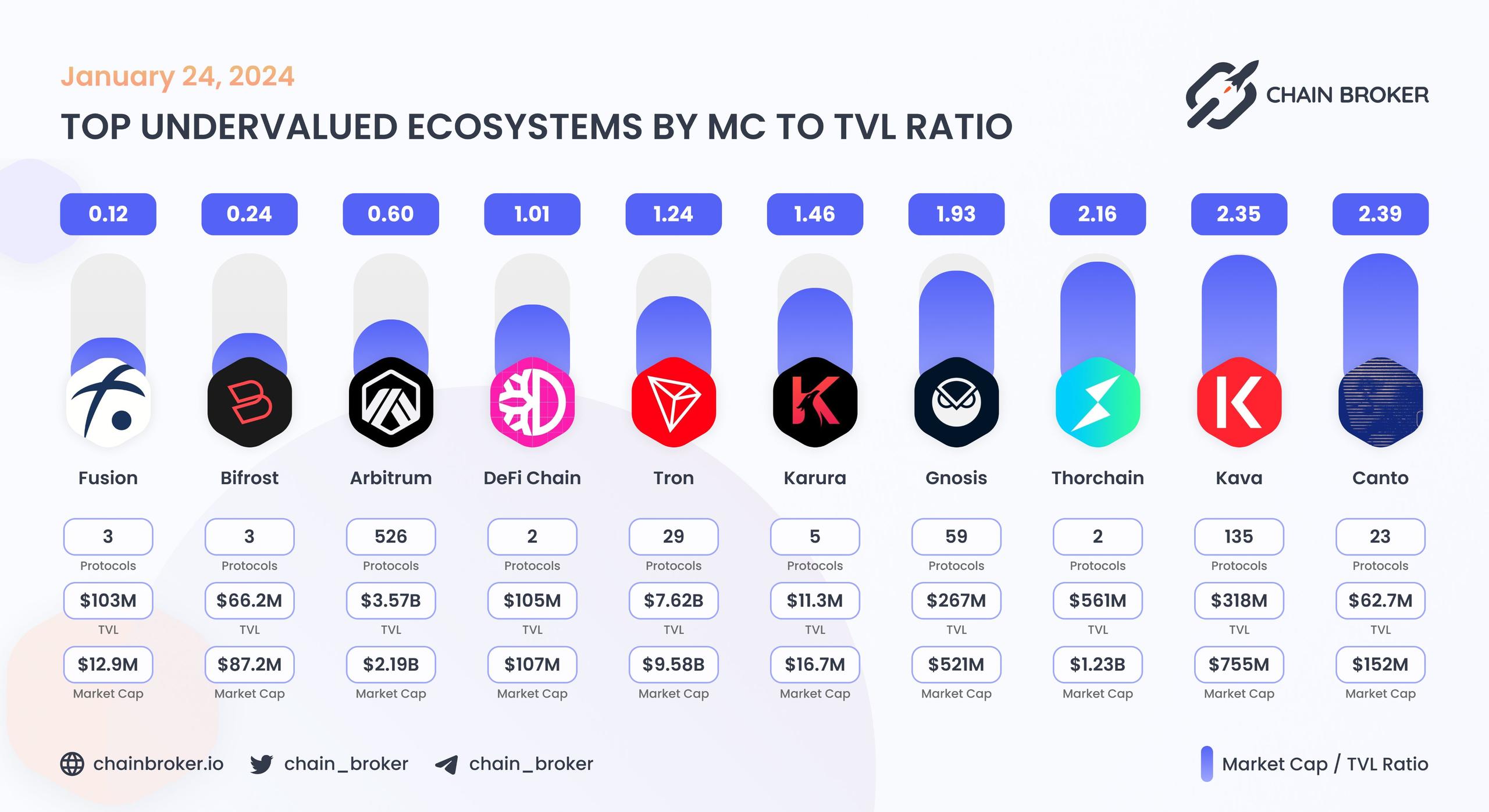

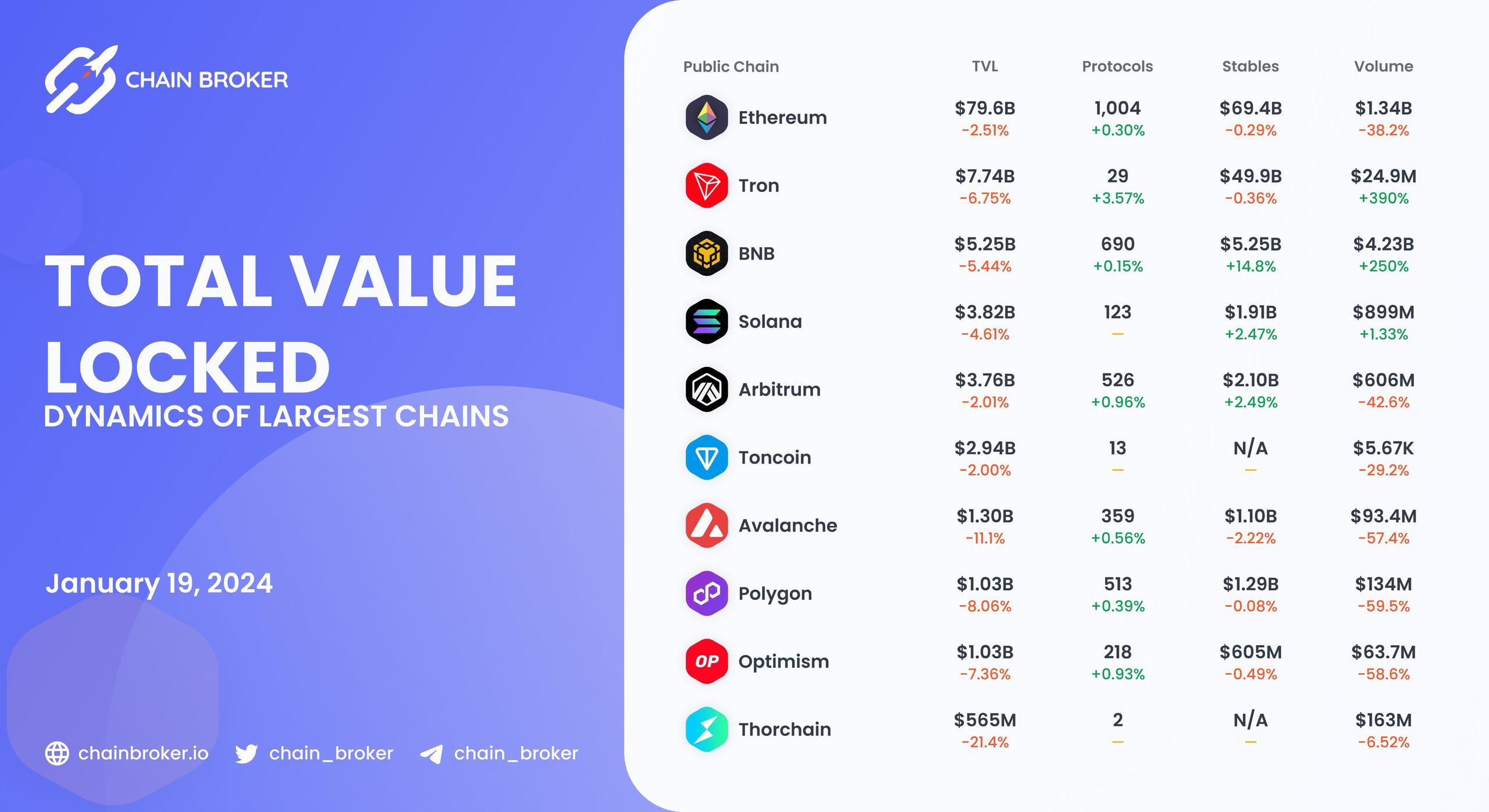

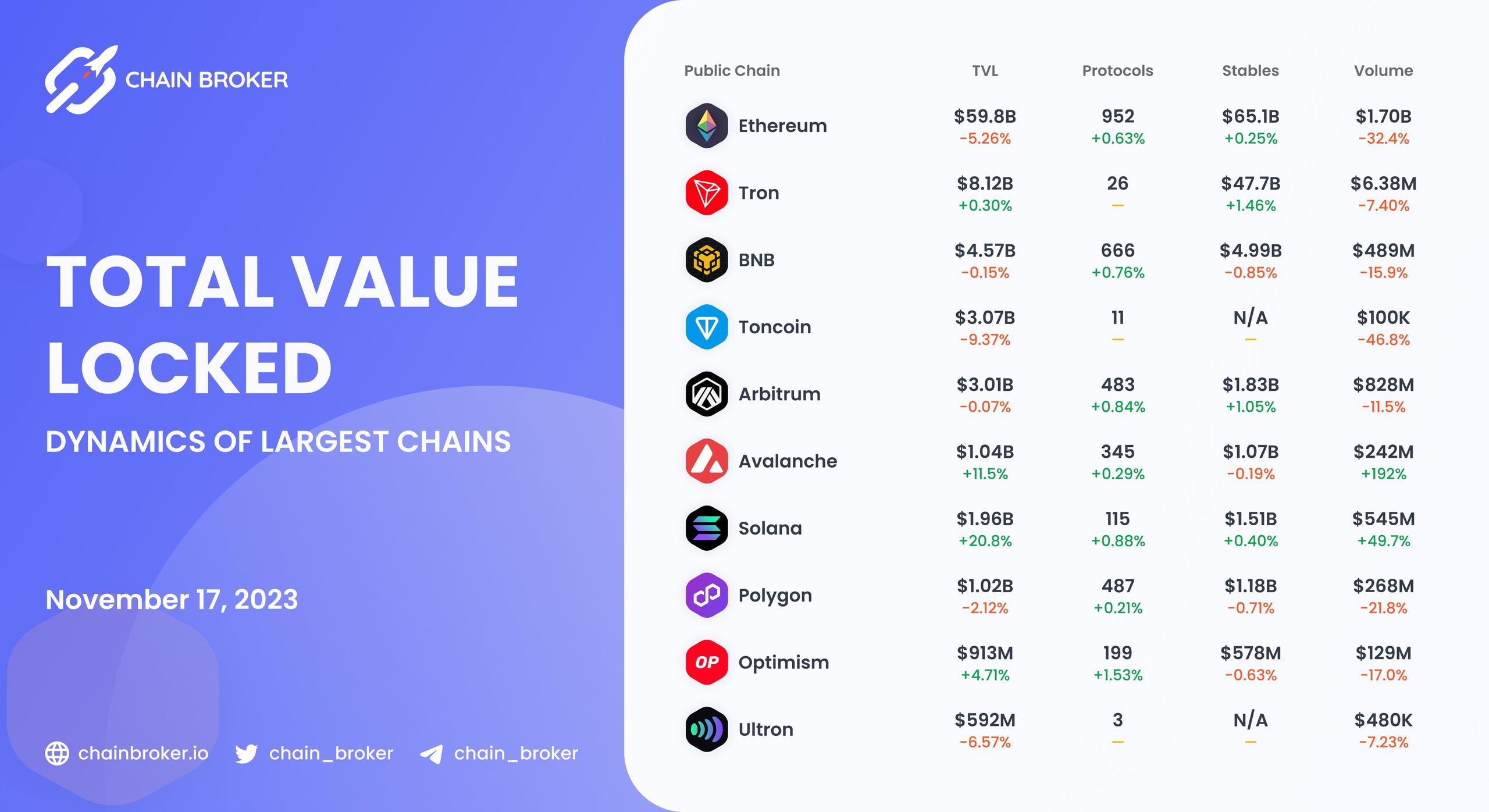

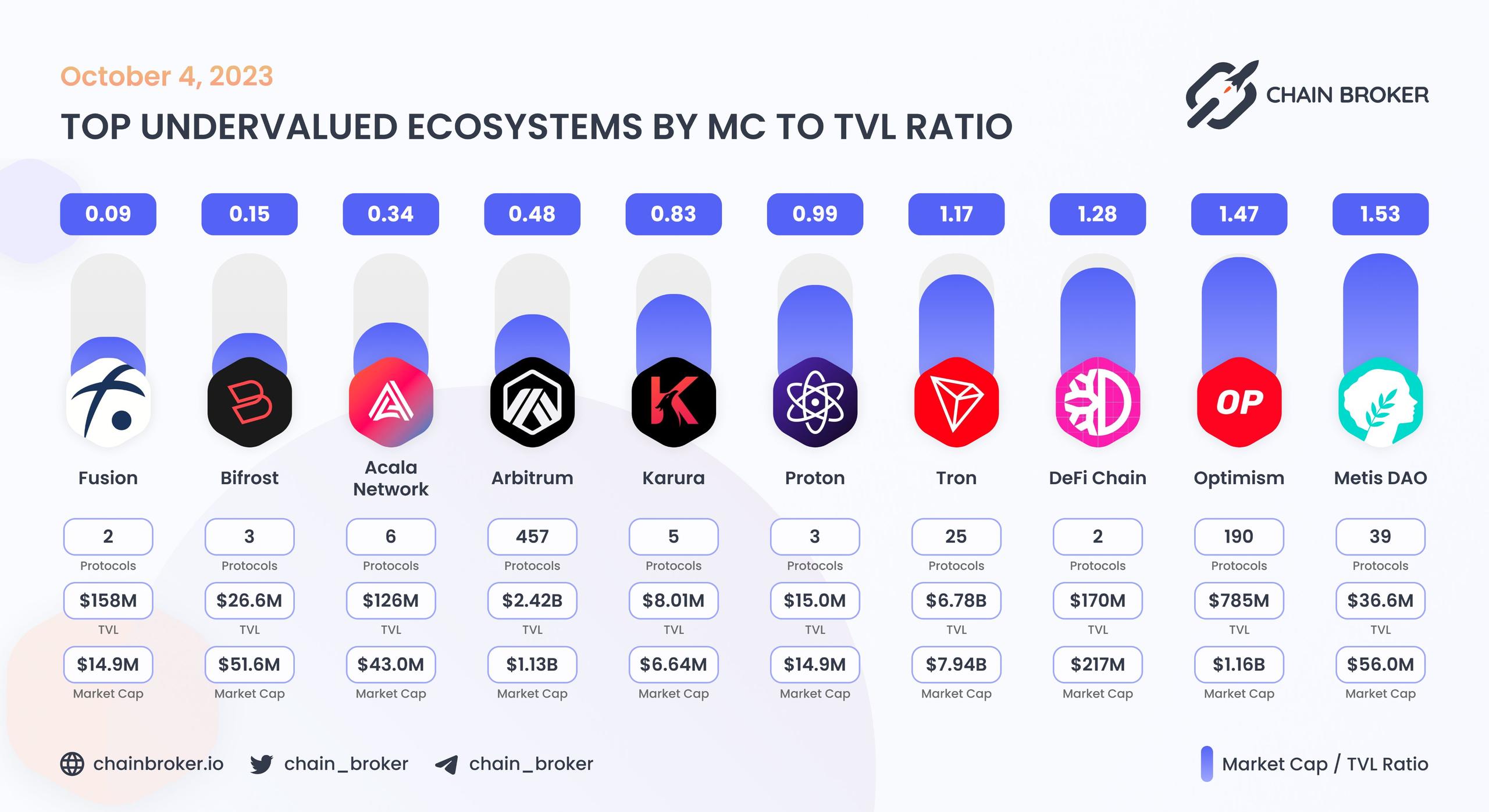

Arbitrum Market Cap

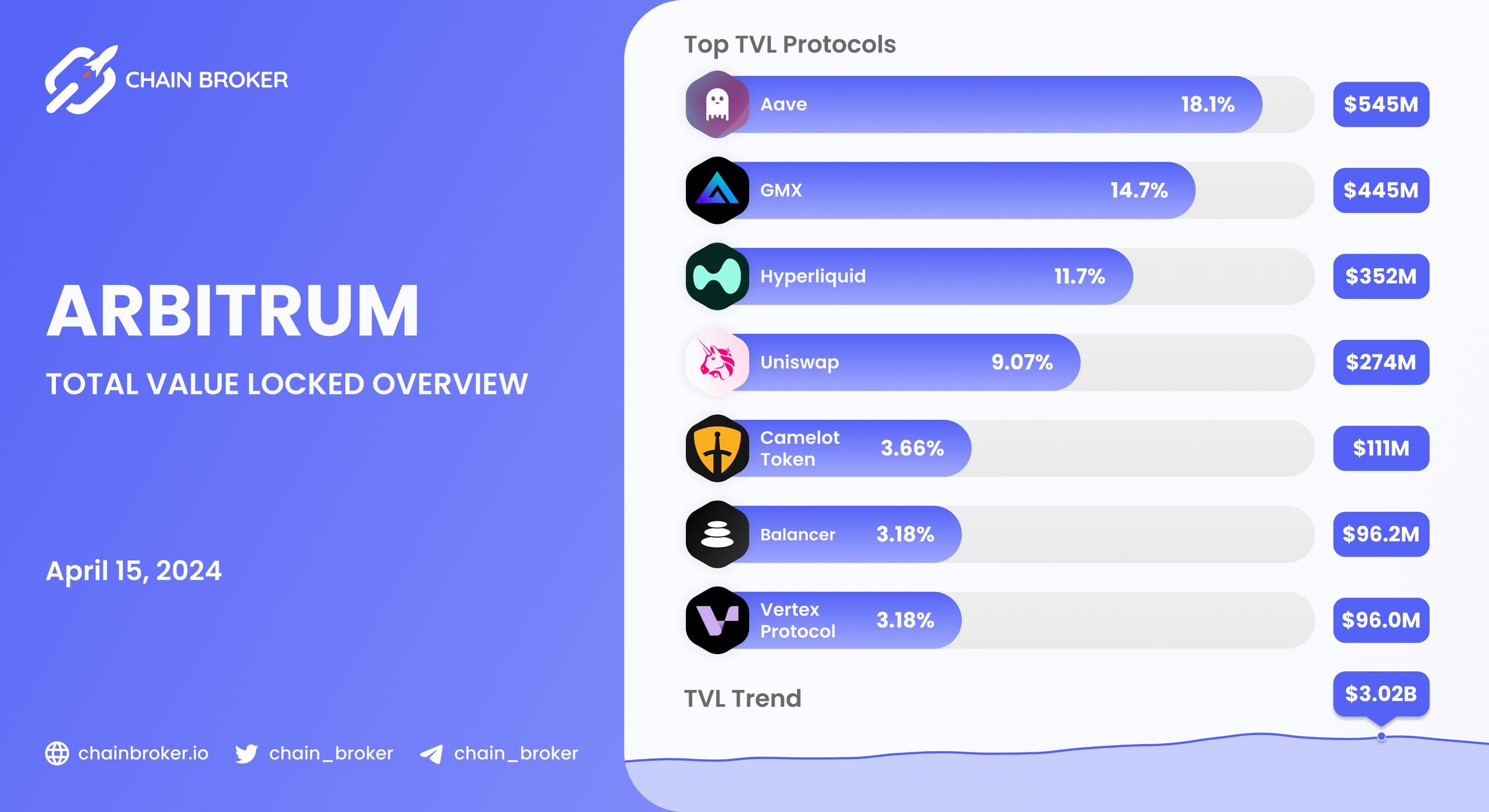

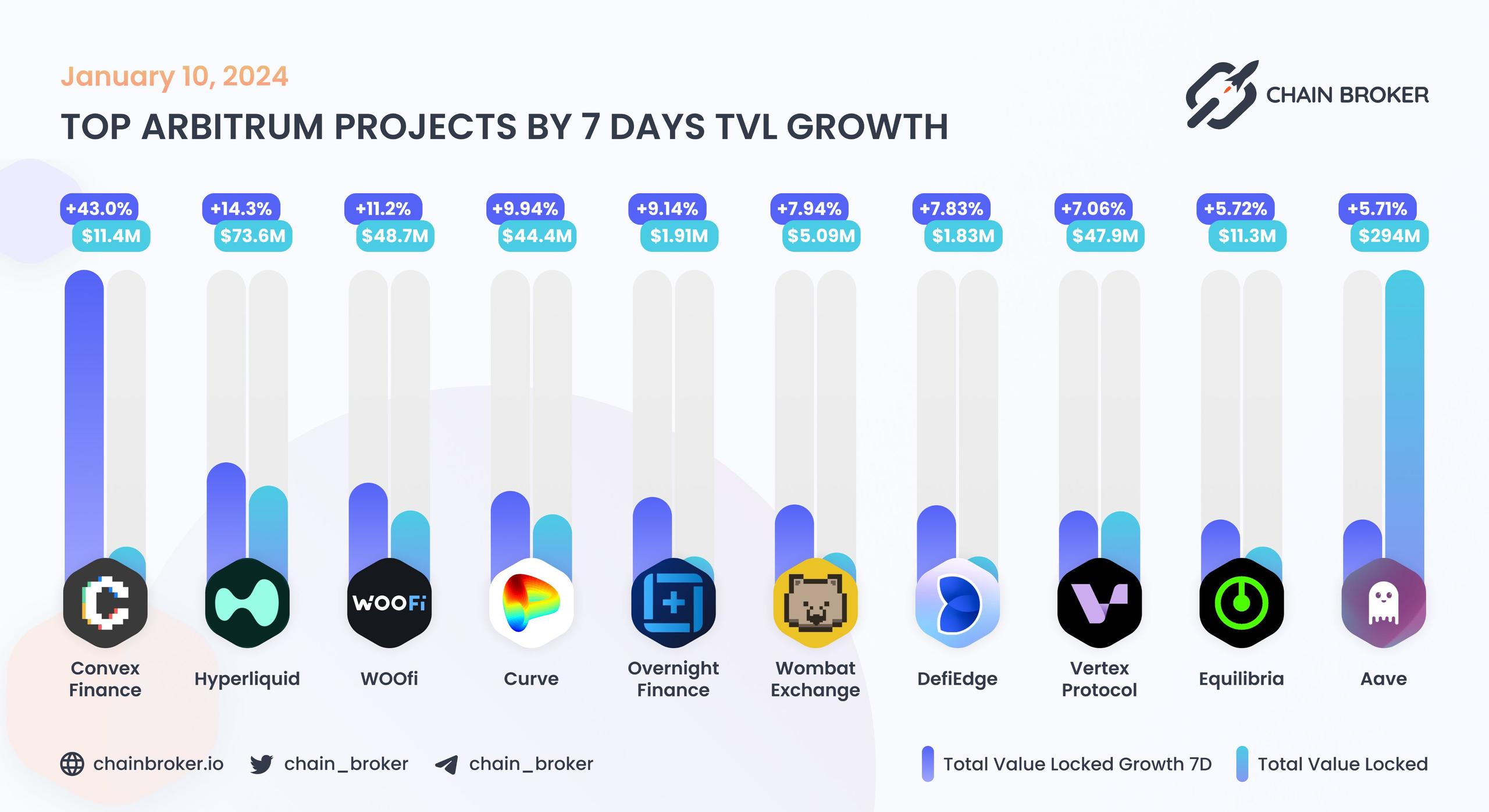

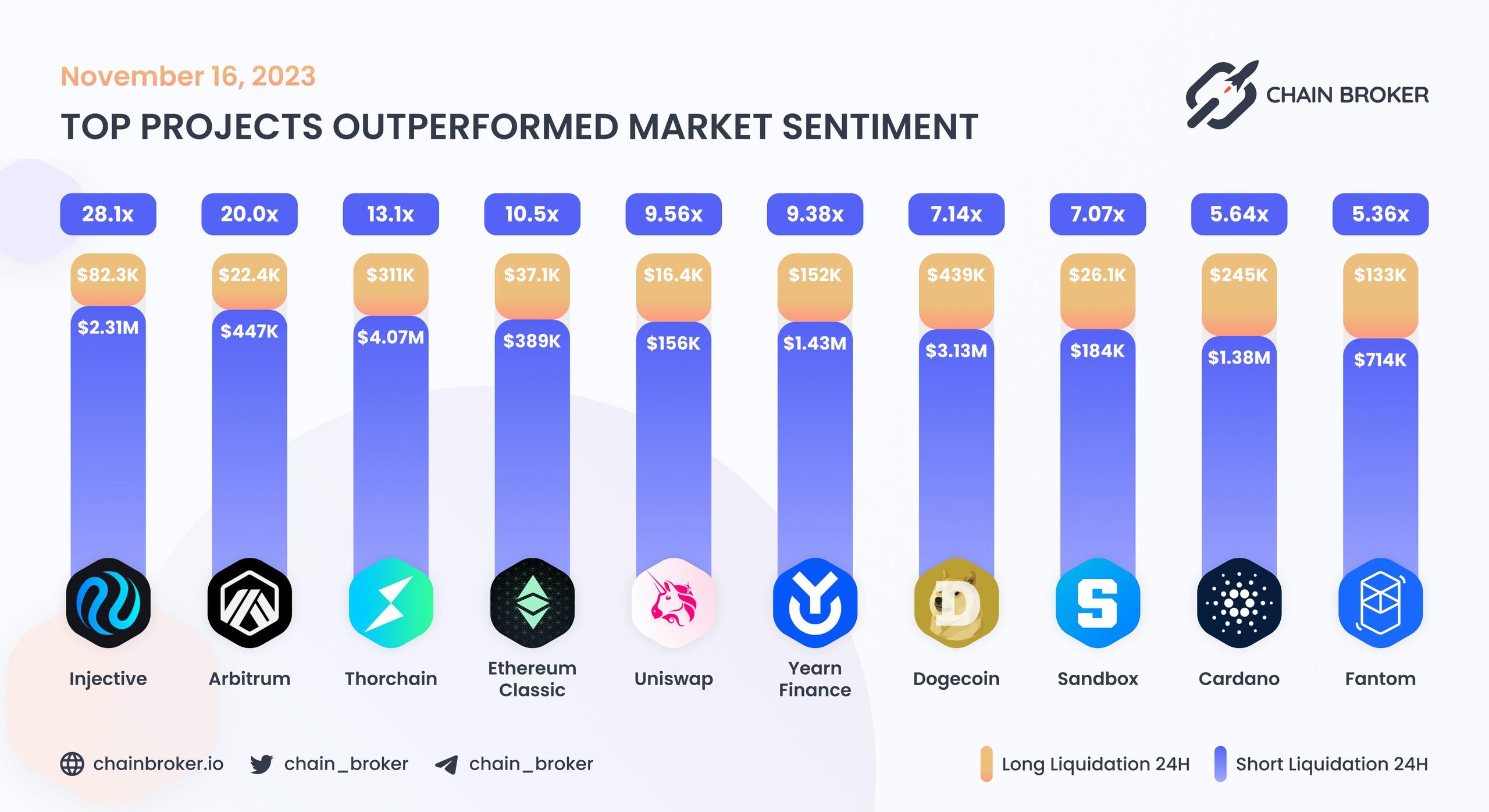

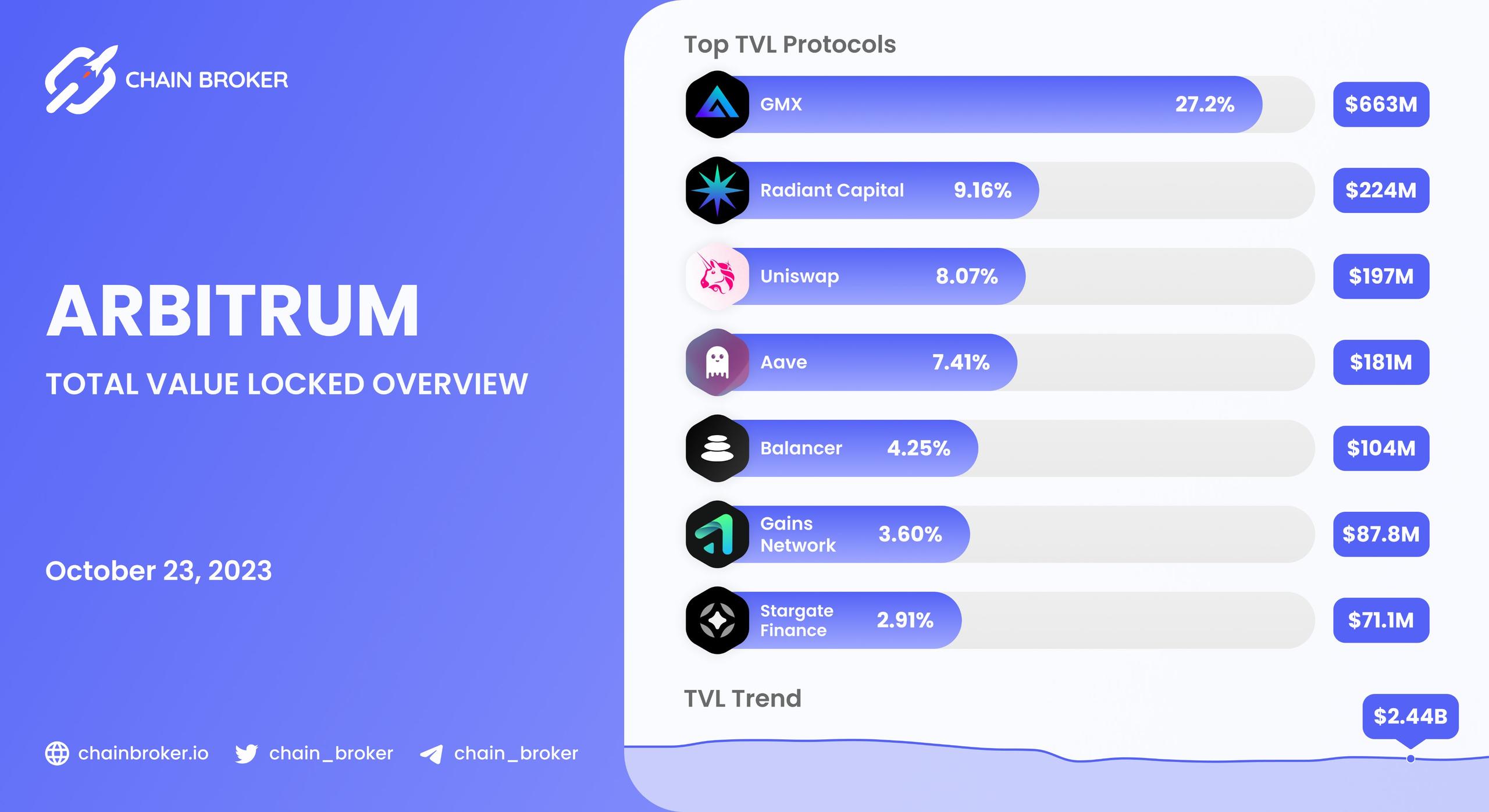

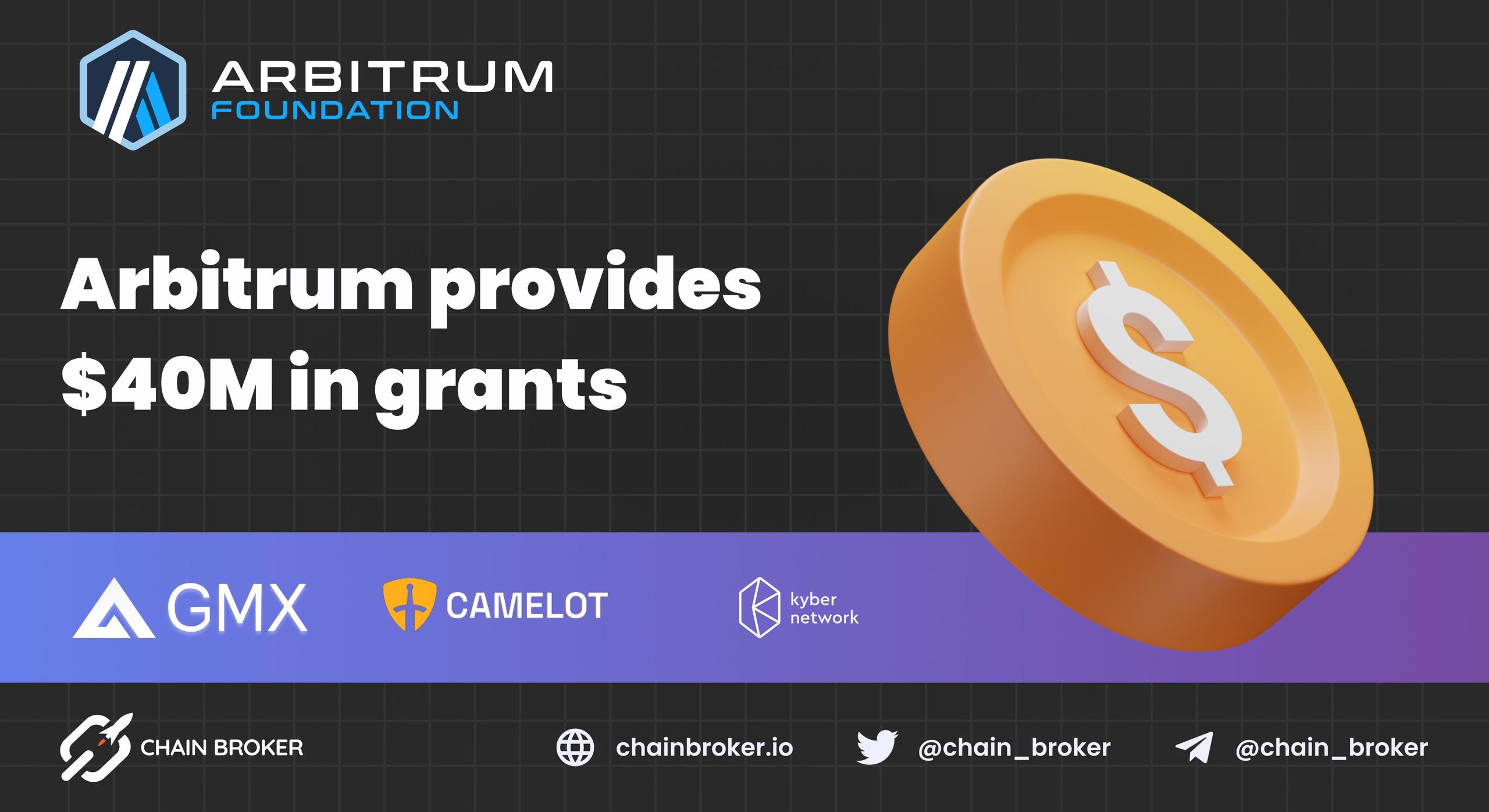

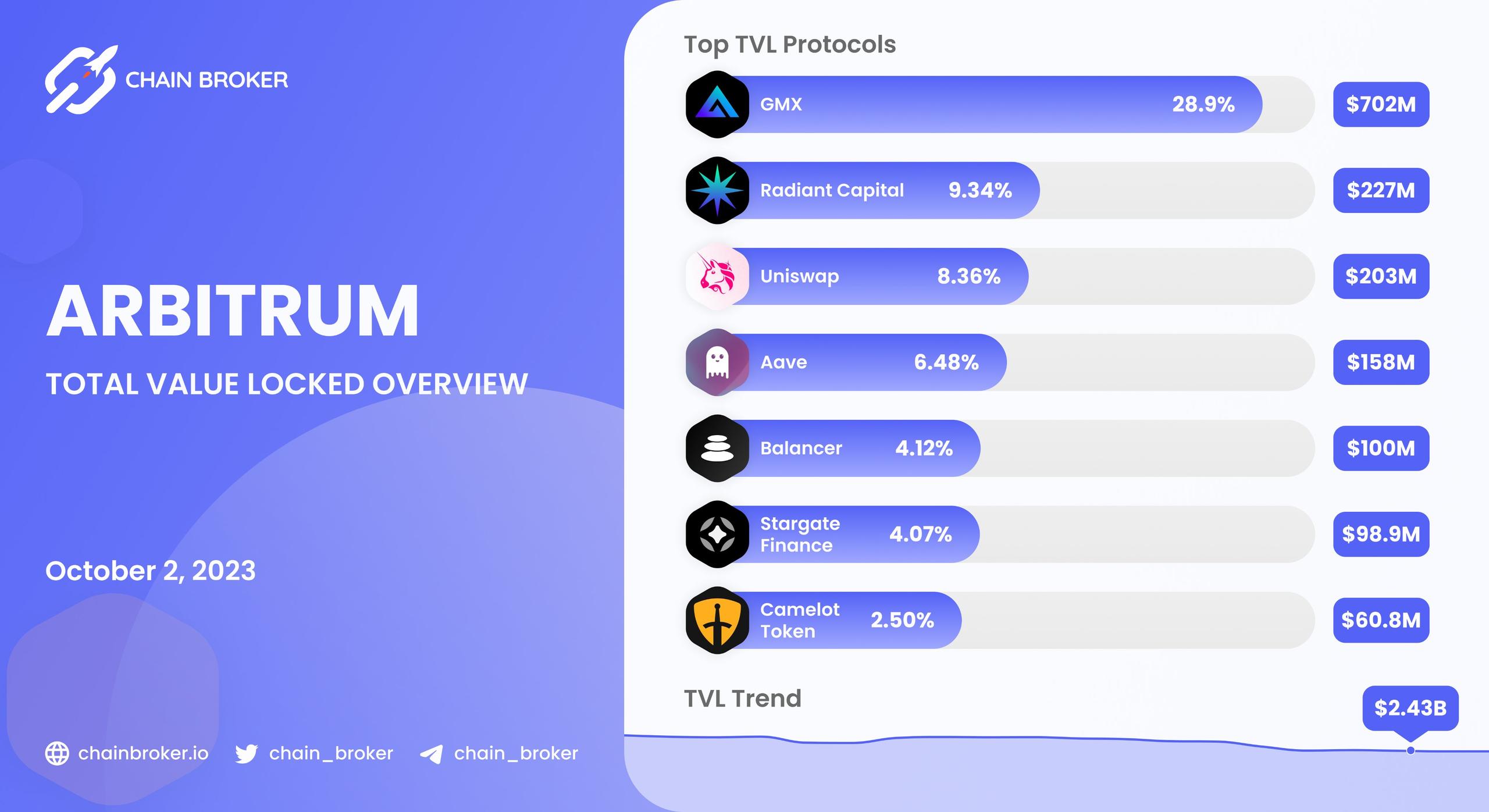

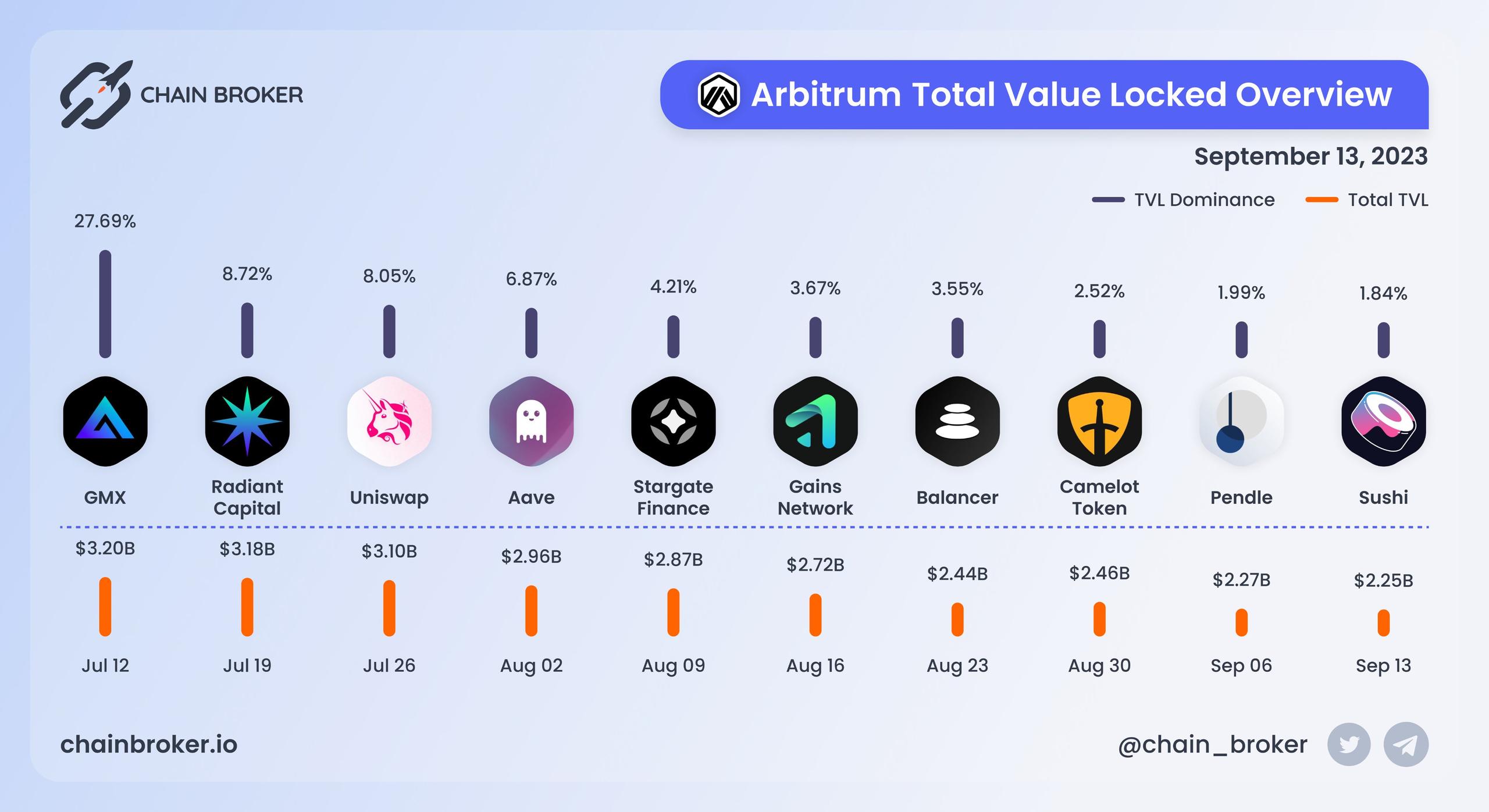

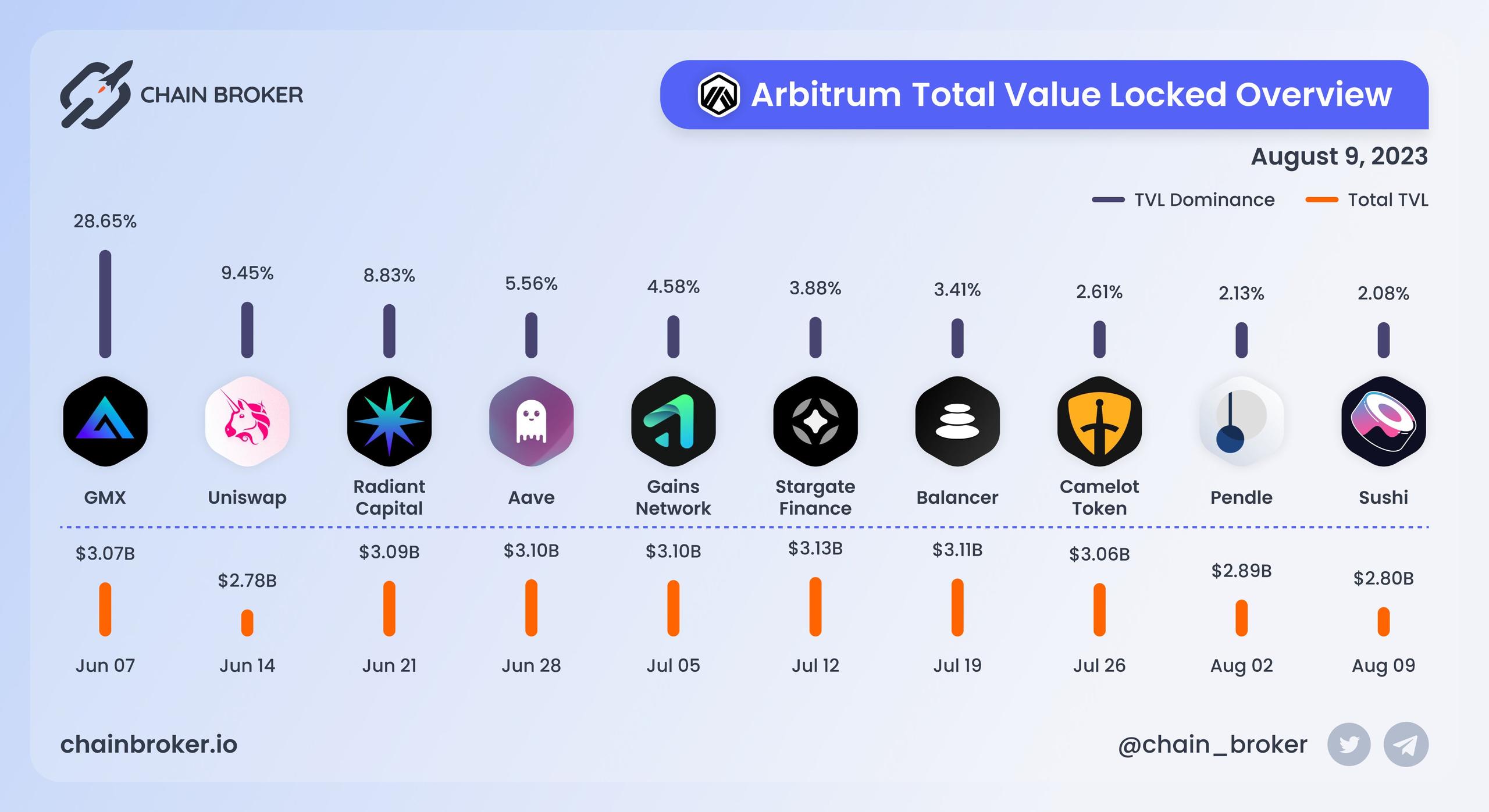

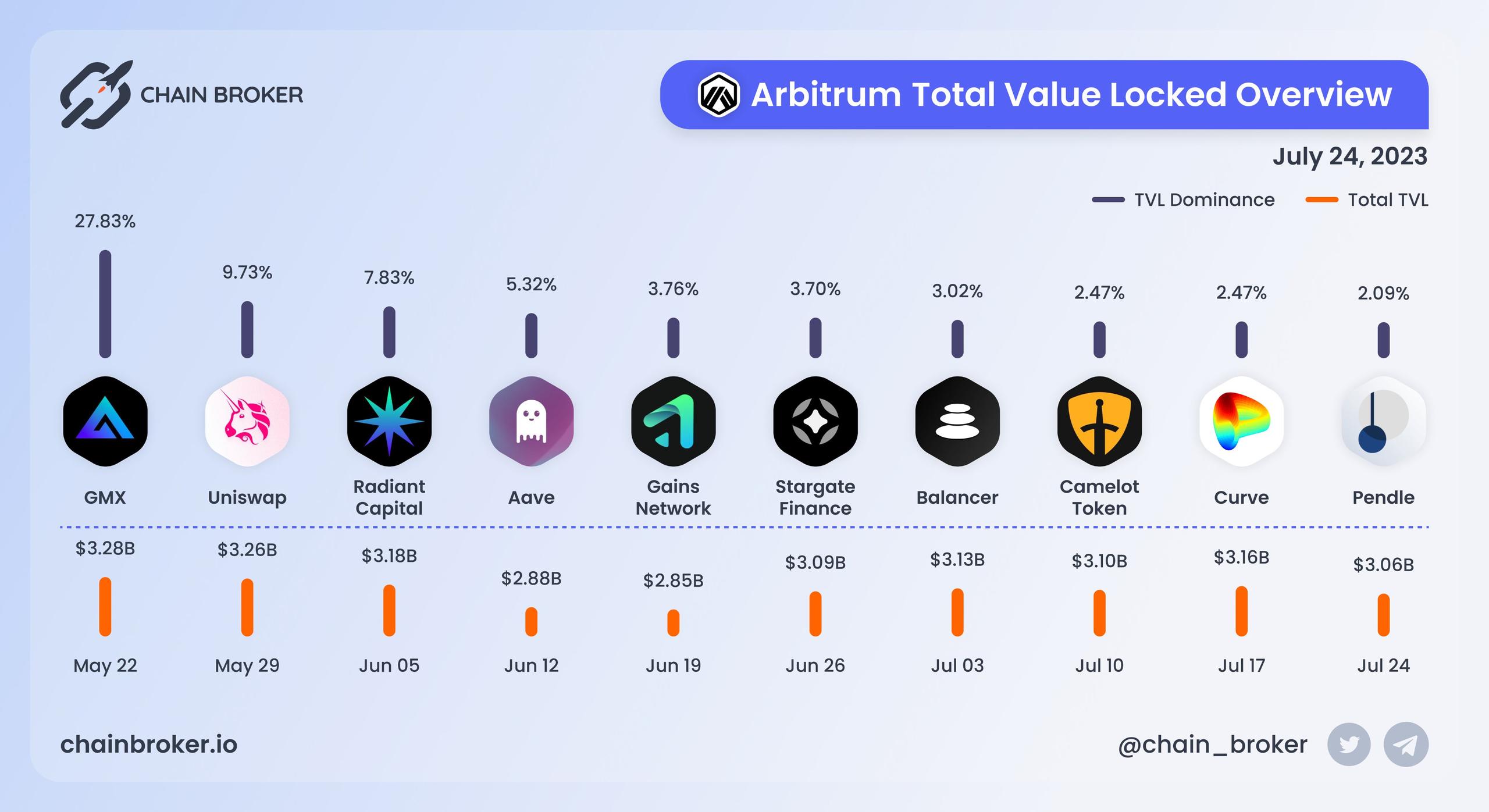

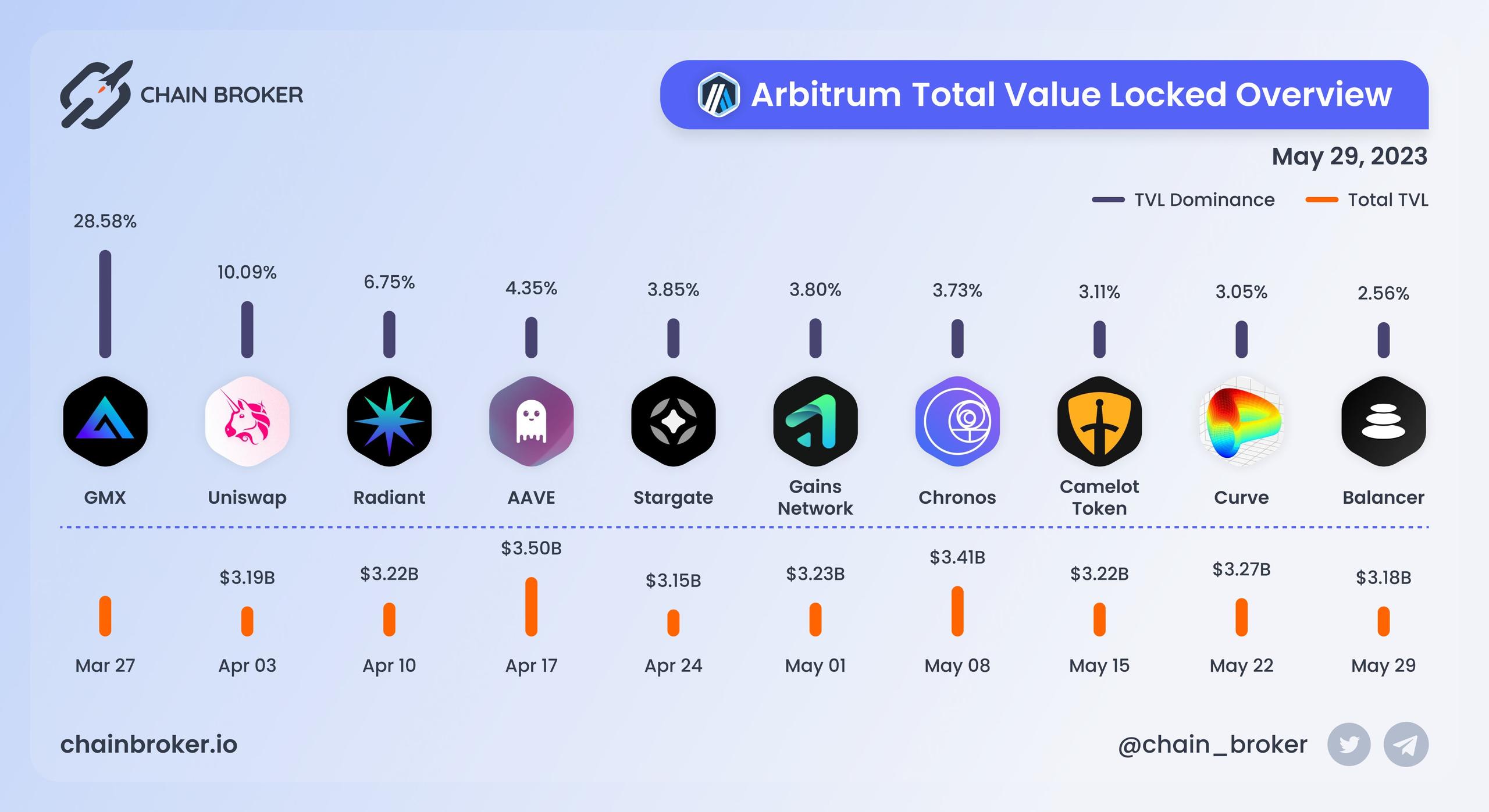

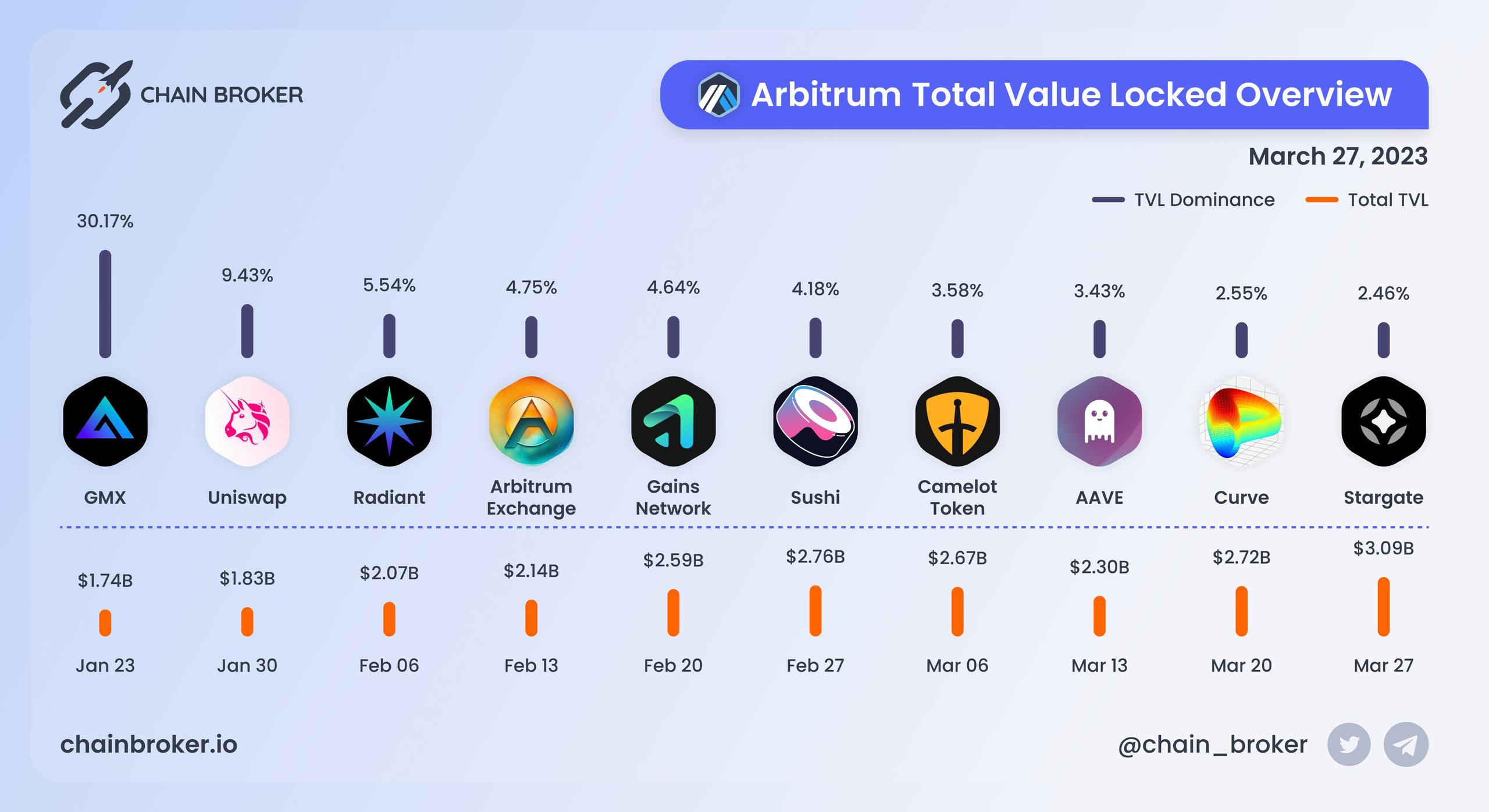

GMX

Uniswap

Aave

Stargate Finance

Sushi

Loading...

Loading...Arbitrum Token Distribution Chart

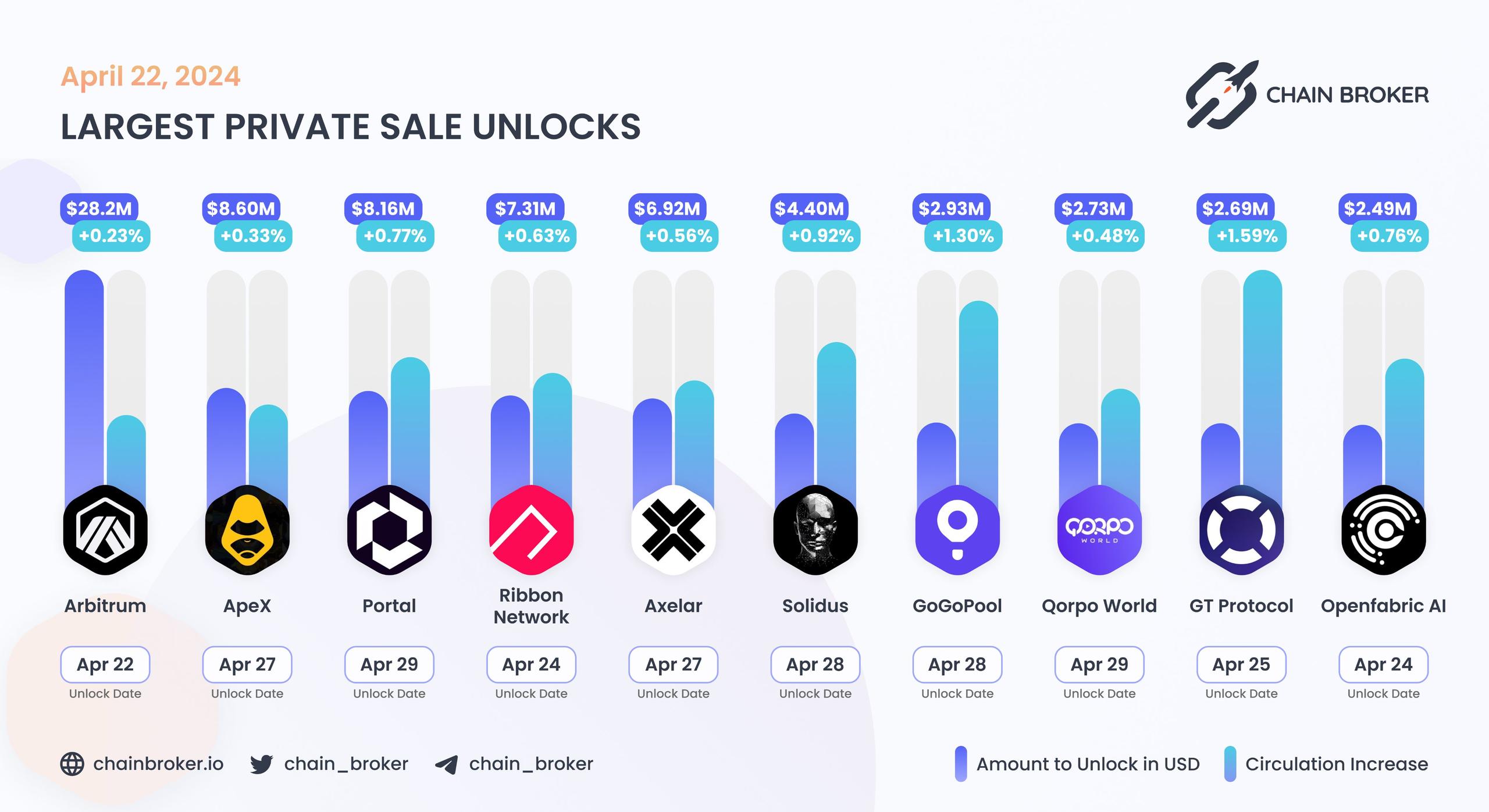

Stage | Price | Total Raise | Valuation | Vesting Period |

|---|---|---|---|---|

Seed Round | $0.005 | $3.76M | $50M | 0.0% tge, 12 months cliff, 2.78% monthly |

Series A Round | $0.12 | $20M | $1.2B | 0.0% tge, 12 months cliff, 2.78% monthly |

Series B Round | $0.12 | $100M | $1.2B | 0.0% tge, 12 months cliff, 2.78% monthly |

Team & Advisors | 0.0% tge, 12 months cliff, 2.78% monthly | |||

Airdrops | 100% unlocked | |||

DAO | 100% unlocked | |||

Treasury | Dependent upon the approval of the governance DAO through a voting process | |||

What is Arbitrum?

About the Arbitrum crypto project

Arbitrum is a layer 2 scaling solution for Ethereum that aims to address the scalability and high transaction fees associated with the Ethereum network. Built by Offchain Labs, Arbitrum provides a more efficient and cost-effective platform for decentralized applications (dApps) and smart contracts, enabling them to scale and operate with significantly lower gas fees.

At its core, Arbitrum utilizes a technology called optimistic rollups, which are a type of layer 2 scaling solution. Optimistic rollups work by batching multiple transactions off-chain and then submitting a single proof to the Ethereum mainnet, reducing the congestion and cost of on-chain transactions. This approach enables faster transaction processing times and significantly reduces gas fees, making it more feasible for dApps to operate at scale.

One of the key advantages of Arbitrum is its compatibility with the Ethereum Virtual Machine (EVM), which means that existing Ethereum dApps and smart contracts can be easily ported and deployed on Arbitrum. This allows developers to leverage the existing Ethereum ecosystem and infrastructure while benefiting from the improved scalability and cost efficiency provided by Arbitrum.

Arbitrum is designed to be secure and trustless. Through the use of cryptographic proofs, Arbitrum ensures that all off-chain transactions and computations are valid and can be verified on the Ethereum mainnet. This provides a high level of security and prevents any potential malicious activities or fraud.

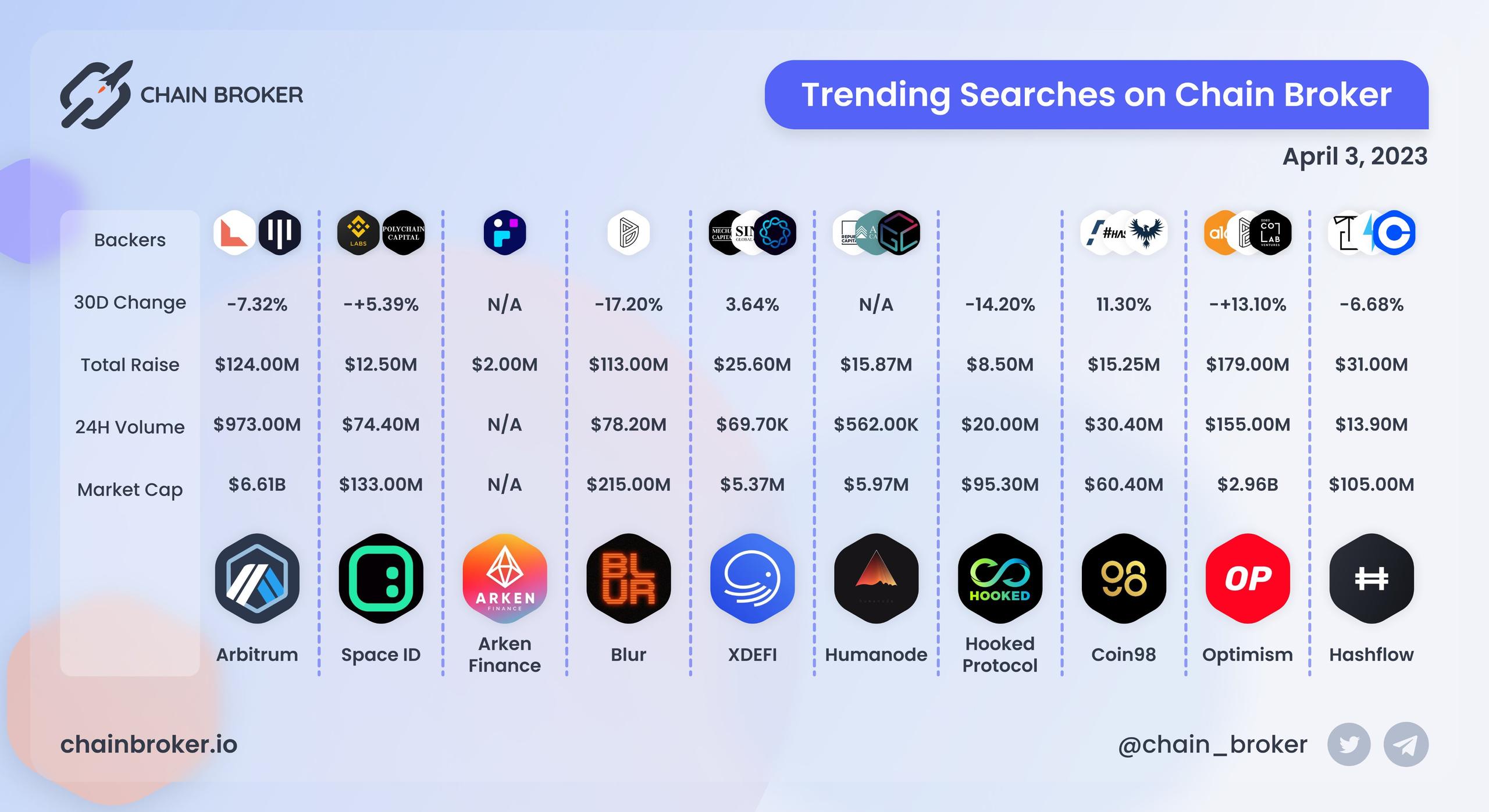

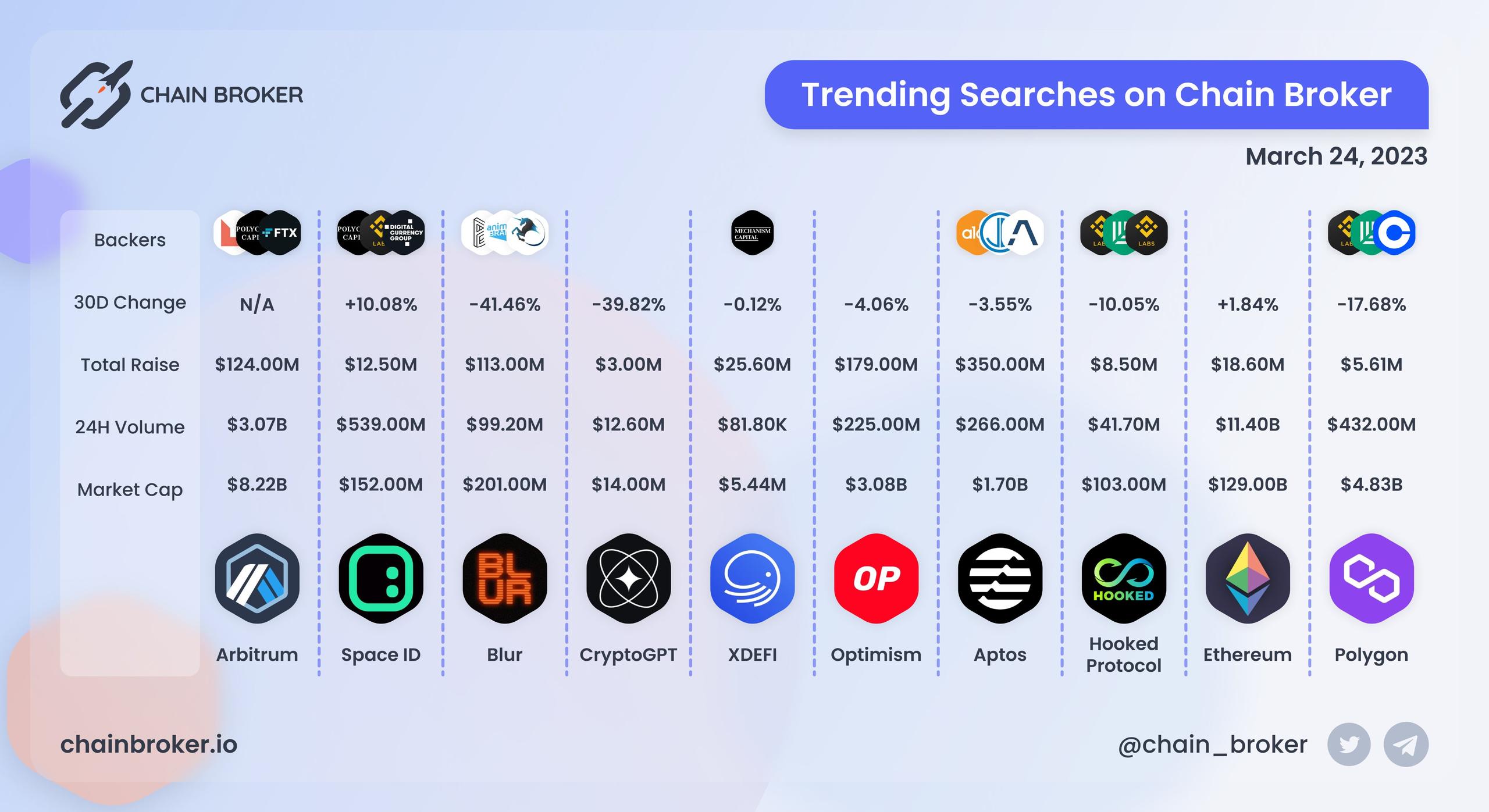

All the necessary data for a reliable project research

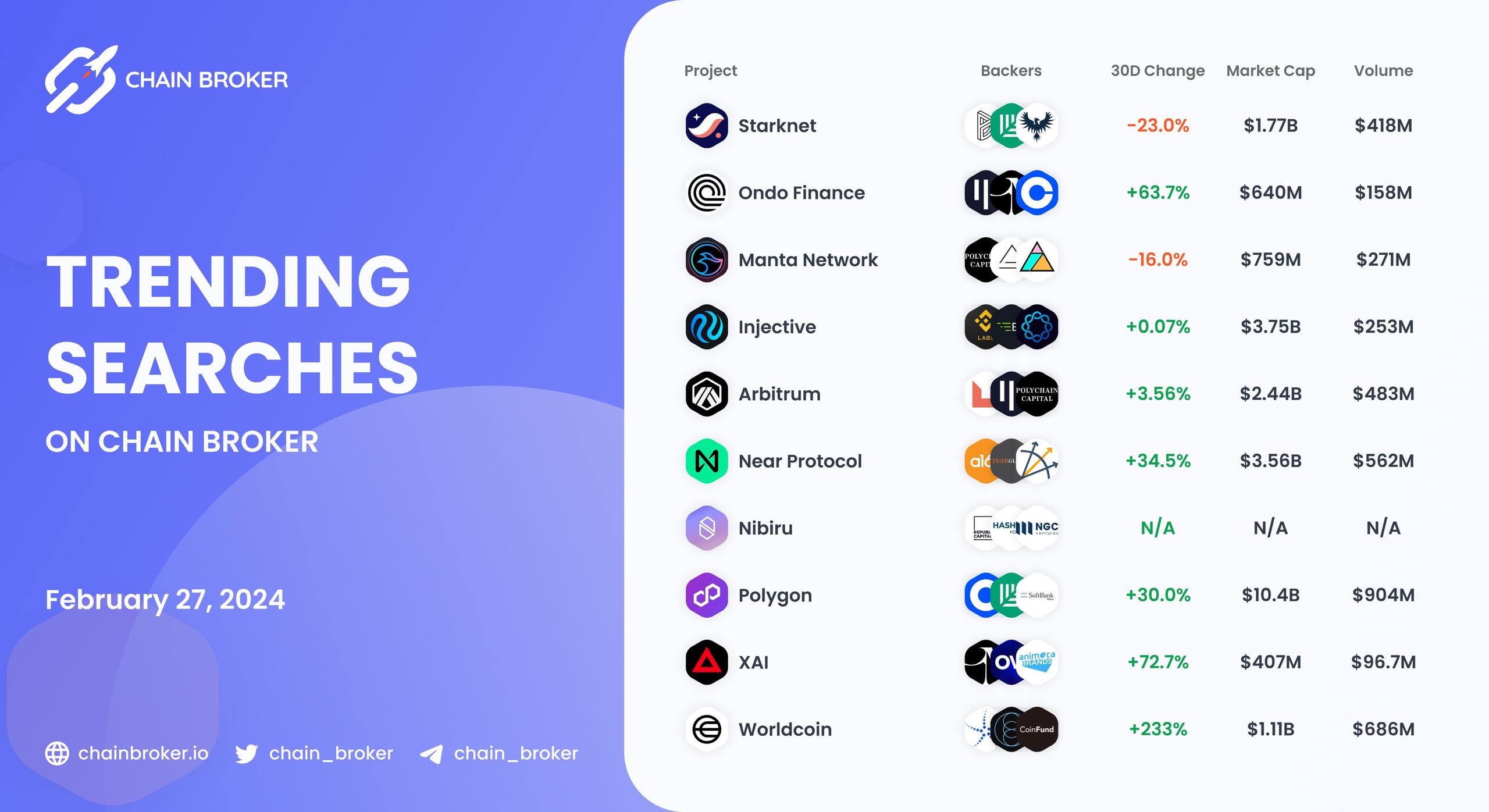

This page contains Arbitrum key metrics such as: current price, market cap, trading volume, price change, and other relevant information like project backers, twitter network and public sale platforms, that can help investors make informed decisions about investing in Arbitrum.

Arbitrum Price Chart

A price chart for Arbitrum displays the historical trading data for the asset, including private and public prices, highest and lowest prices, and the current price. The chart is designed to help traders analyze the price movements of Arbitrum and understand how current price relates to other price points. The chart will typically be accompanied by data, like: current price, all time high price, all time low price, private price, and public price.

Arbitrum ATH Price

ATH stands for All-Time High. In the context of cryptocurrency, it refers to the highest price that a particular coin or token has ever reached. For example, if the price of Bitcoin reached $40,000 for the first time, that would be considered its ATH.

Arbitrum ATH Price is $2.39

Arbitrum ATL Price

The All-Time Low (ATL) price is the lowest value the token has ever reached on a crypto exchanges. It's a historical data point which can help to gauge the token performance over time and make investment decisions.

Arbitrum ATL Price is $0.2457

Arbitrum Public Price

The public price - is the value of the token at initial offering either via initial coin offering, initial dex offering, or initial exchange offering. This is the price a token or a coin was offered to public before it is available for trading. Public price is useful for traders and investors to gauge the advantage of current value of an asset over value offered to the public investors.

Arbitrum Private Price

The private price - refers to the value of the token, that is negotiated and agreed upon between private parties, usually institutional investors or high net worth individuals. These prices are not publicly available and are not influenced by the overall market conditions or trading activity. They may be based on a set of specific terms and conditions, such as lock-up periods or minimum investment amounts, and may differ significantly from the public price.

Arbitrum Private Price is $0.12

Arbitrum Current Price

The curent price is the current market value of a token or a coin, available on crypto exchanges, changes constantly, influenced by market conditions, news & trading activity. Useful for traders and investors to make informed decisions.

Arbitrum Current Price is $0.3452

Arbitrum Price Change for 24h, 7d, 14d, 30d and 1y periods

The price change for a specific period for Arbitrum project - shows how the token's value has changed over that period of time. It's a useful metric to gauge the token's performance.

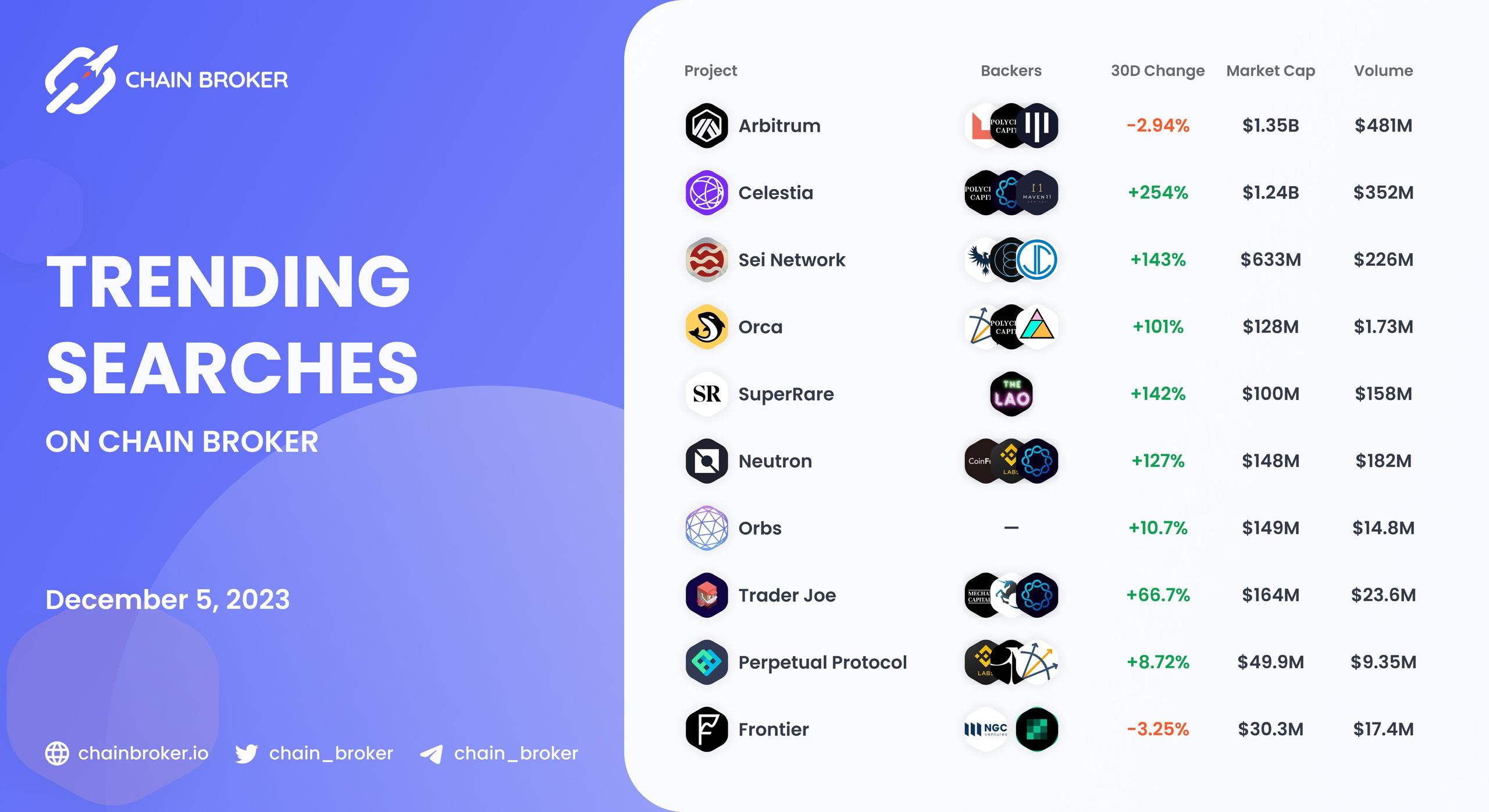

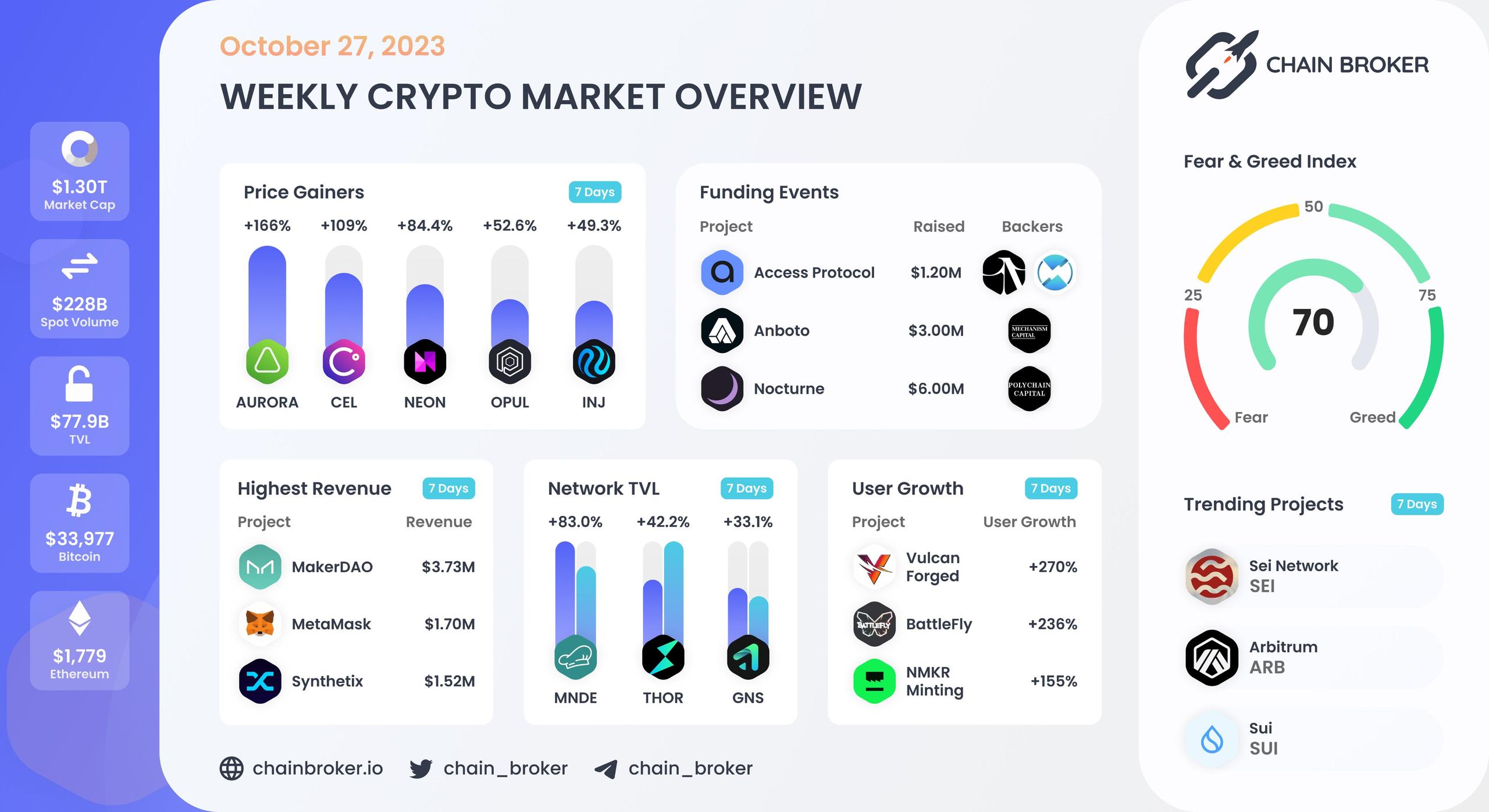

- 24 hours - -0.515% (Zero point five one five percent);

- 7 days - 19.9% (Nineteen point nine percent);

- 14 days - 2.42% (Two point four two percent);

- 30 days - 0.701% (Zero point seven zero one percent);

- 1 year - -56.4% (Fifty six point four percent);

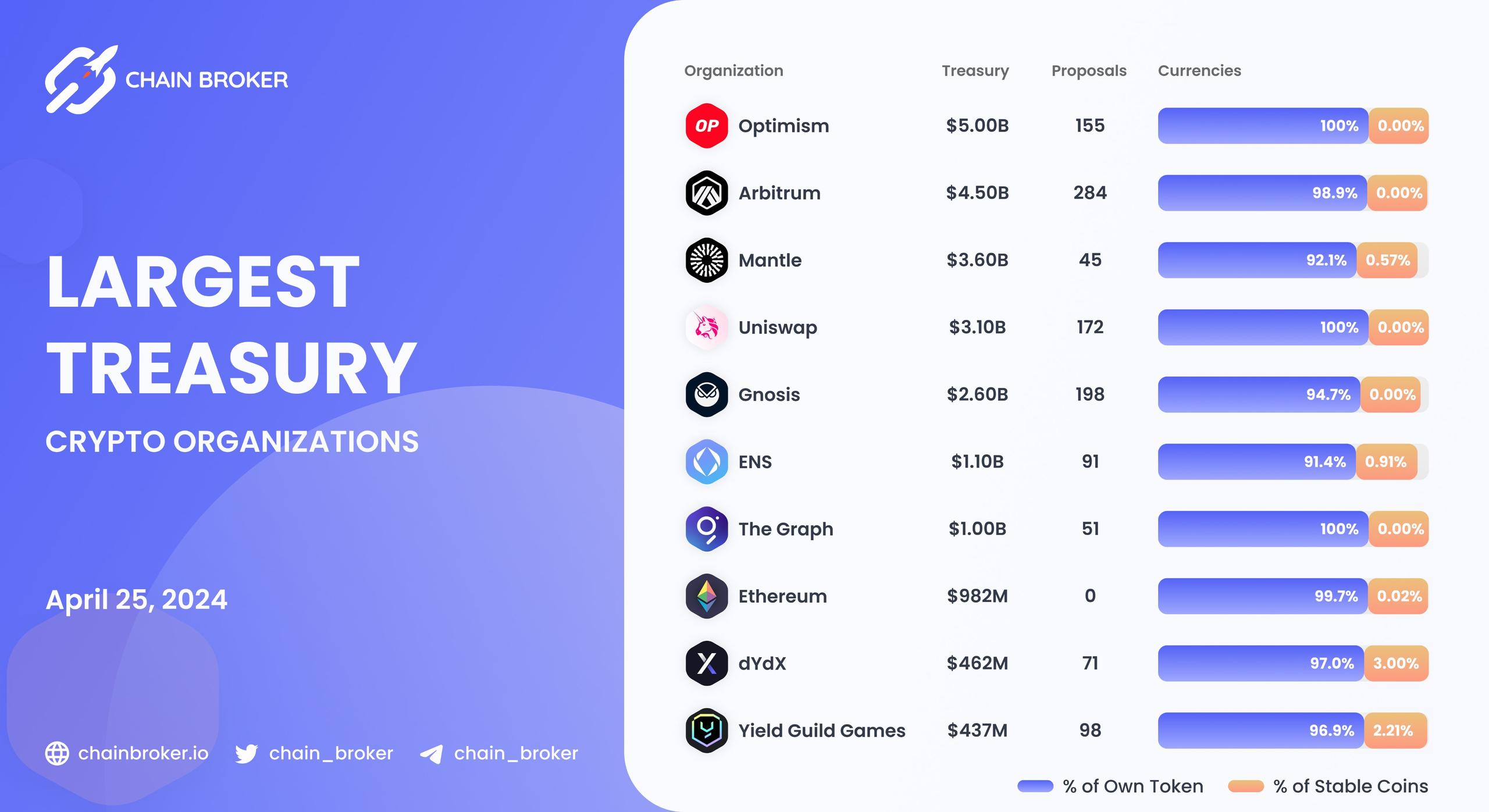

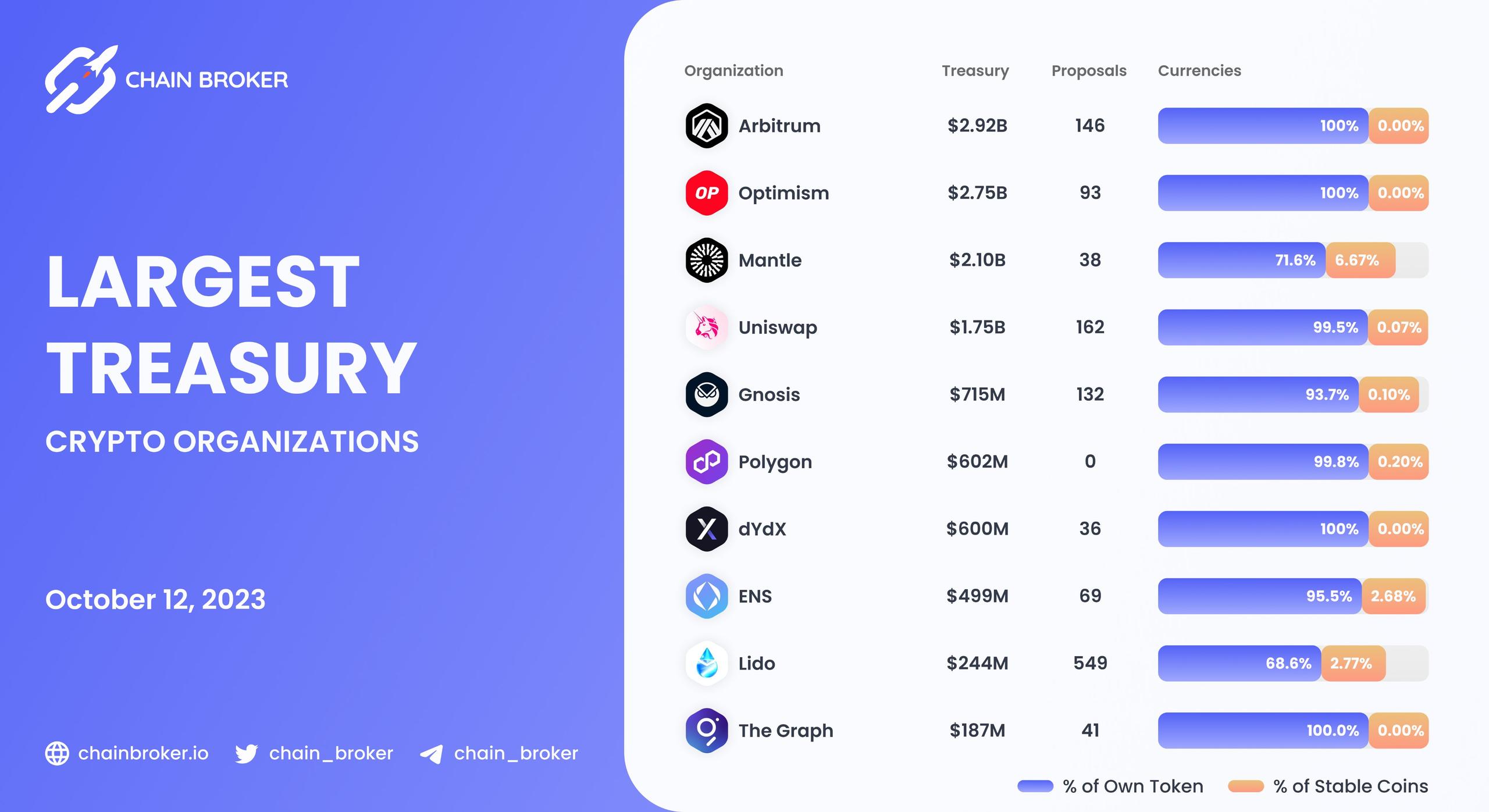

Arbitrum Market Cap

Market Cap for Arbitrum is a metric to determine the current value of the project. Calculated by multiplying all the tokens in circulation by the current price. It is a metric used to gauge the size of the project and its relative importance in the crypto market.

Arbitrum Initial Market Cap

Initial Market Cap for Arbitrum crypto project is the total value of available tokens in circulation at the time of the initial coin offering (ICO) or initial listing on a cryptocurrency exchange. It is calculated by multiplying the initial price of the token by the initial circulation of the token. It's a metric used to gauge the size of the project and its relative importance in the crypto market at the initial stage of the token's life cycle. It's also a benchmark to evaluate the token performance over time.

Arbitrum Initial FDMC

Initial FDMC (Fully Diluted Market Cap) of Arbitrum project - refers to the project valuation at the time of the initial coin offering (ICO) or initial listing on a cryptocurrency exchange.

Arbitrum FDMC

FDMC (Fully Diluted Market Cap) for Arbitrum is the project valuation at current price. It takes into account all the tokens including available for trading in the open market and the ones that are locked up or restricted. It's a metric used to gauge the liquidity of a token and the market's perception of its value.

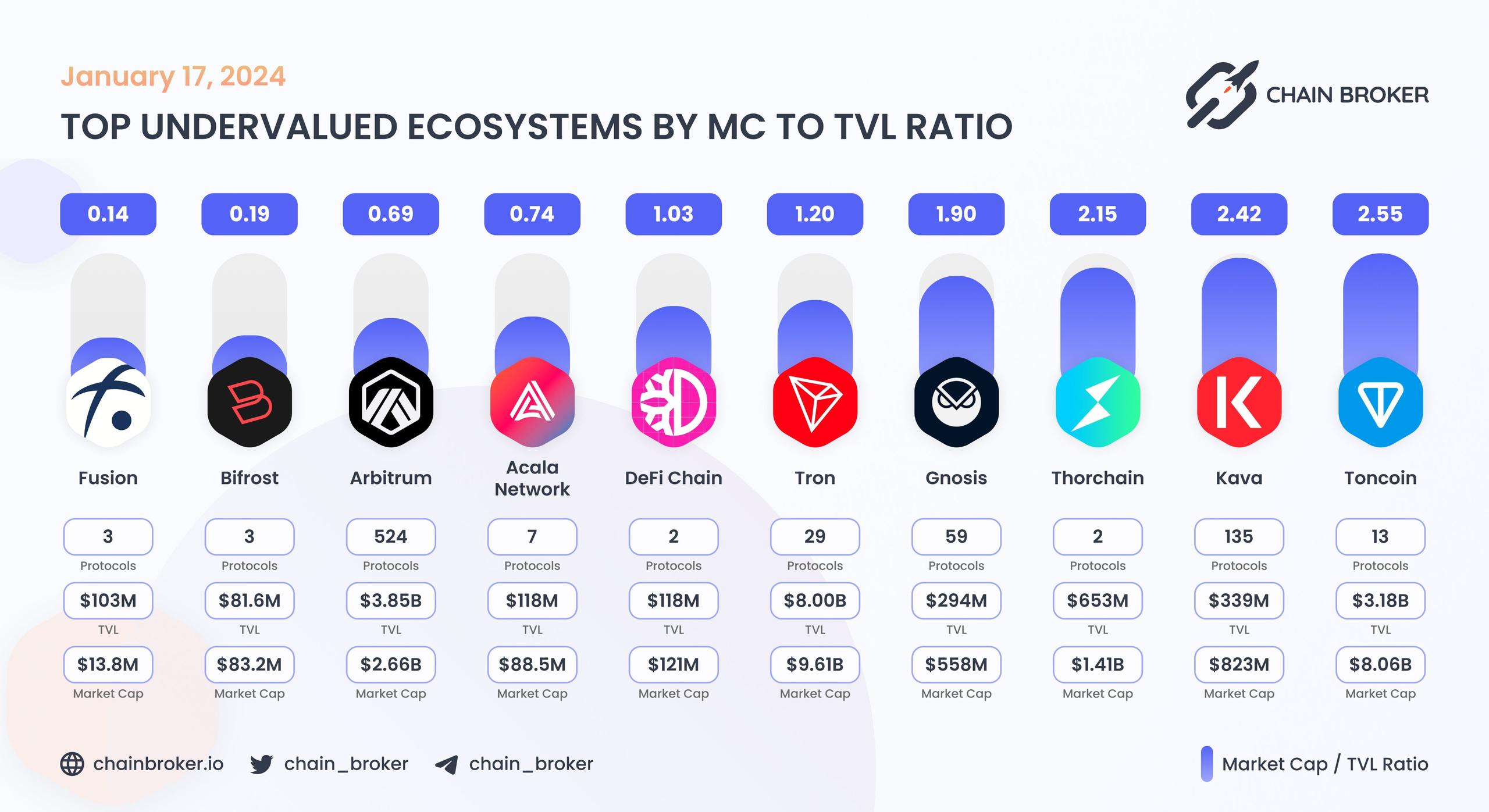

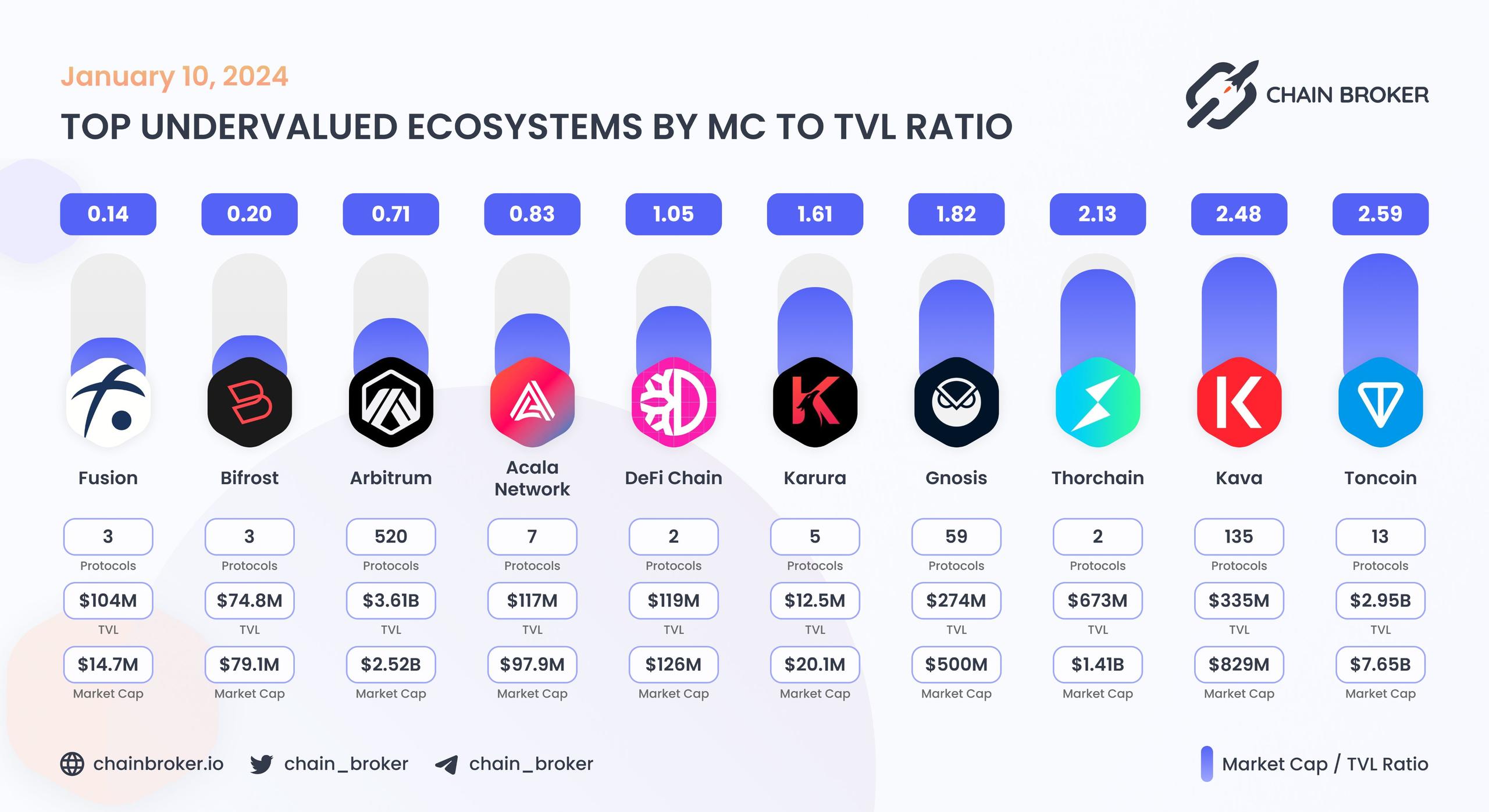

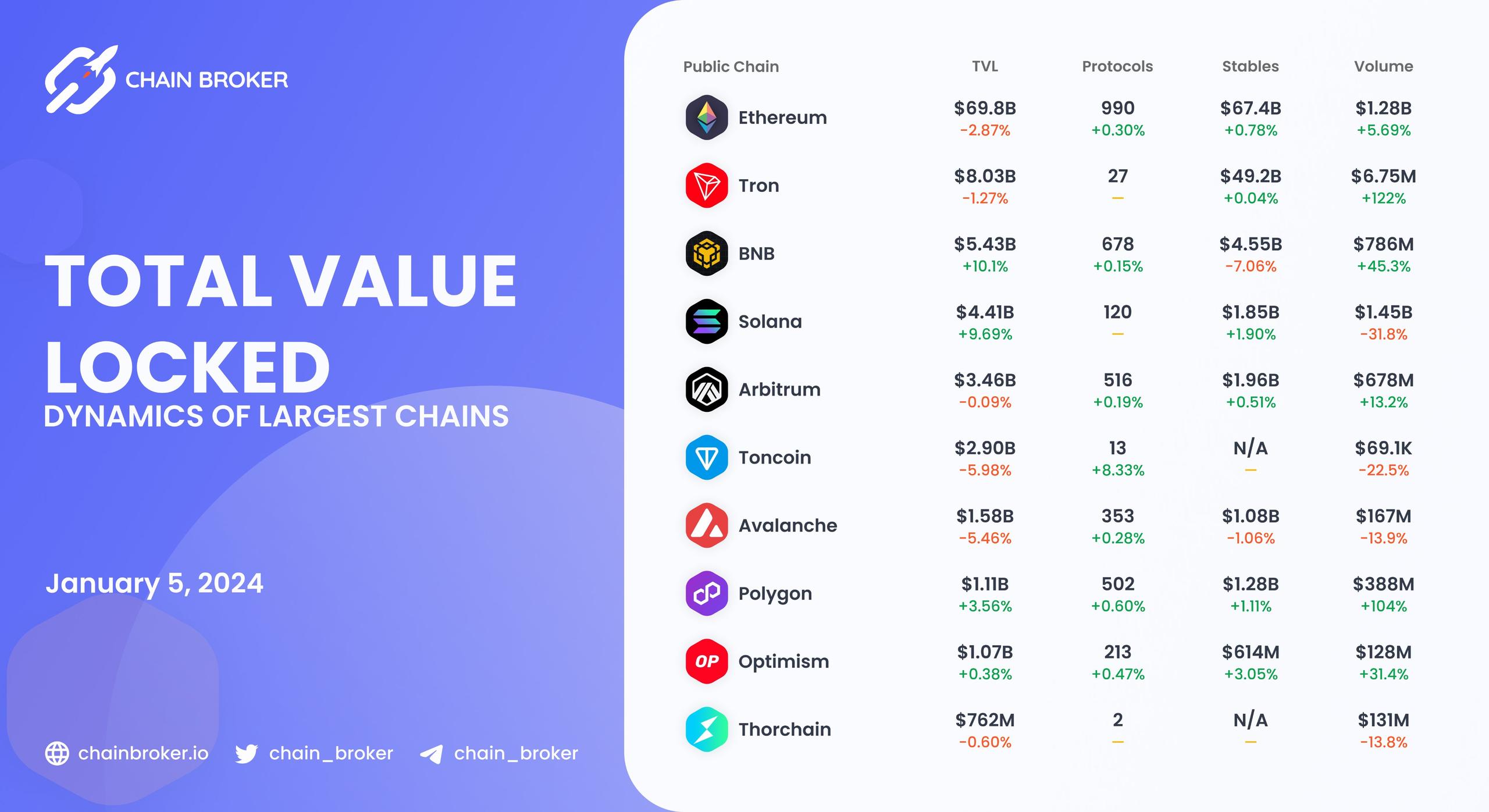

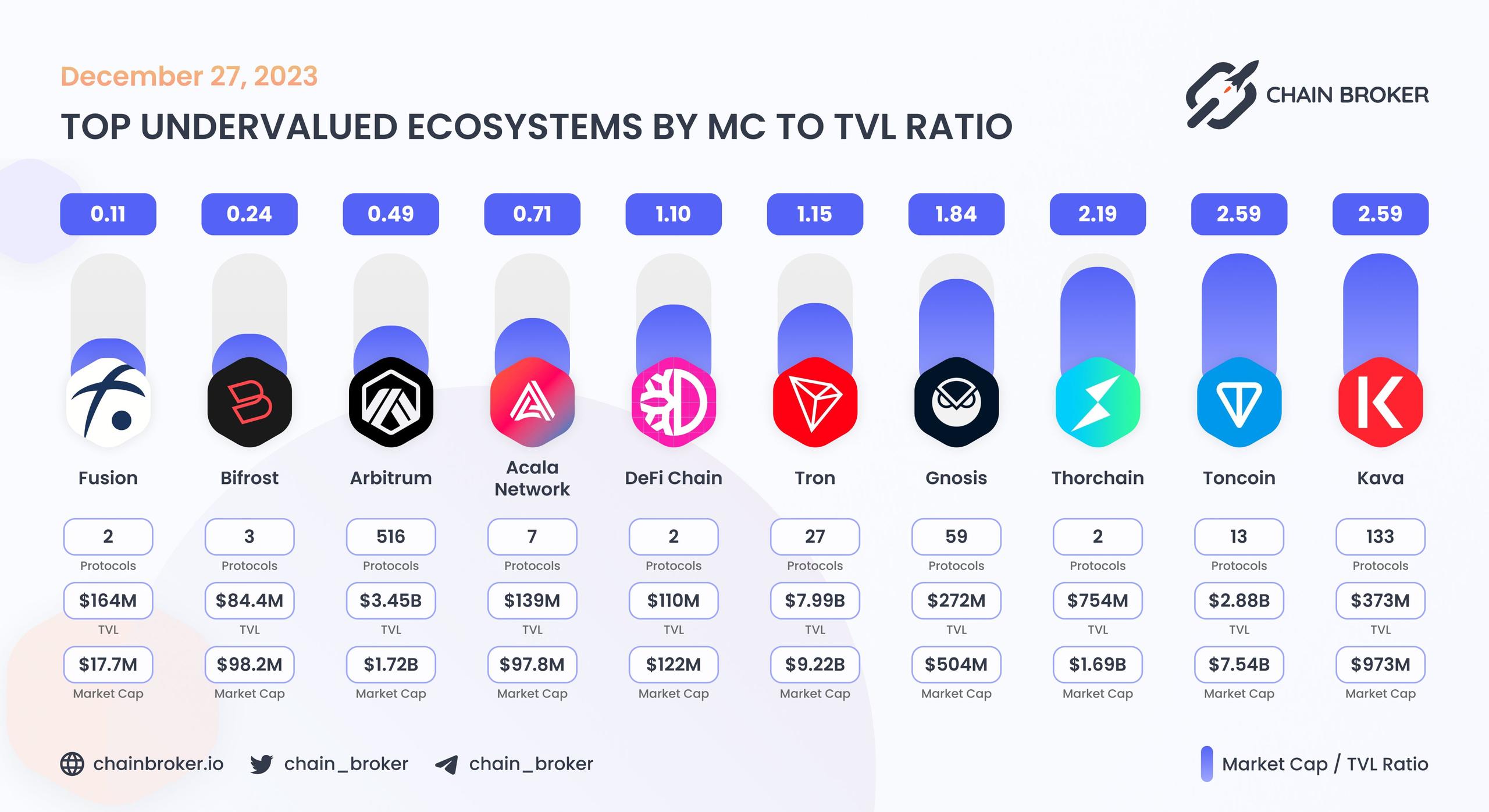

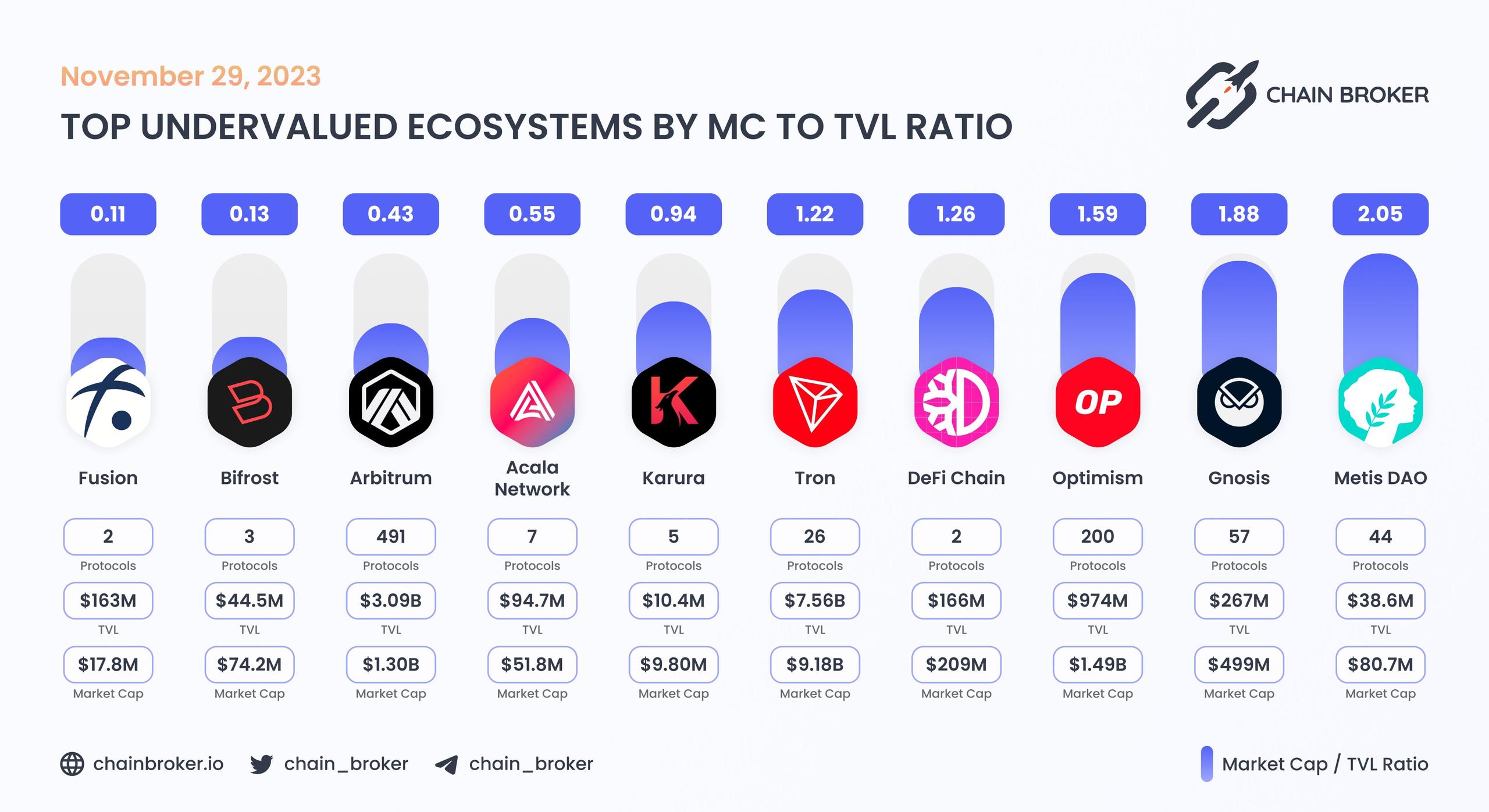

Arbitrum FDMC is $3.45B

Arbitrum Market Cap

Market Cap is the total value of all the tokens in circulation, calculated by multiplying the current price of the token by the current circulation of the token. It is a metric used to gauge the size of the project and its relative importance in the crypto market.

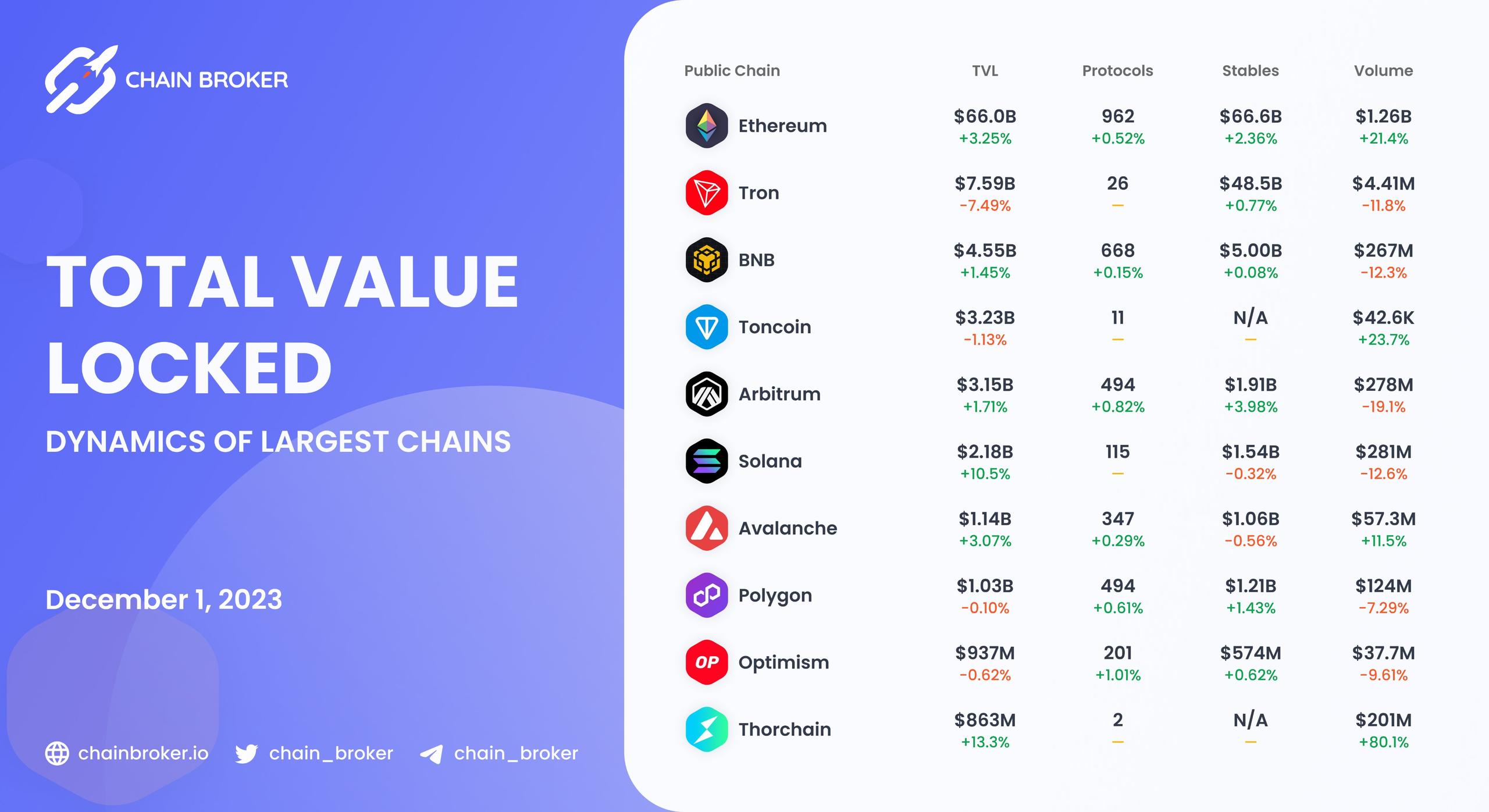

Arbitrum Market Cap is $1.12B

Arbitrum Moonsheet

A moonsheet represents a prediction or a forecast of a future high value for the token. It's a term used by crypto traders and investors for a token that is expected to experience a significant price increase, similar to the moon landing.

Arbitrum Moonsheet ROI

Moonsheet ROI - is the expected return on investment for the token, based on the predicted future value of the token. It's a metric used by crypto traders and investors to evaluate the potential profitability of the investment in the project.

Arbitrum Moonsheet Price

Moonsheet price - is the predicted future high value of the token. It's a term used by crypto traders and investors for a token that is expected to experience a significant price increase, similar to the moon landing. It's a forecasted number that can be used for investment decisions.

Arbitrum Moonsheet Market Cap

Moonsheet Market Cap - is the predicted future market capitalization for the token based on the predicted future value of the token. It's a metric used by crypto traders and investors to evaluate the potential size of the market for the token in the future.

Frequently asked questions

What is the price prediction for Arbitrum?

The price for any crypto project is solely dependent by demand & supply. It crypto project supply is usually available to the public. The current supply of Arbitrum is 3251460240.0, however the total supply is 10000000000.0. Increase in the supply cause decrease in the price given constant demand. As for the demand, it is a determined by various factos, like: utility, project updates, and most important community support. The great starting point for Arbitrum price prediction would be to join its community and analyze their support. Nobody would be able to predict the price, but some key metrics to watch for: future unlocks, price change trend, social activity, valuation, and volume.

How much is Arbitrum crypto worth?

The value of the project is a very important concept to understand before any investment decision. Never look at Arbitrum price alone. The current price is just the last aggreed price between the seller and a buyer. The correct way to understand Arbitrum value is to look at current market cap, which is 1122420332.1492. It is also a good habbit to watch for fully diluted market cap, which is also known as project valuation (value projection at current price). Arbitrum FDMC is 3452050000.0. To add, always consider the project liquidity and volume, which give a larger picture of the project value.

Where can I buy Arbitrum?

There are several options to buy a crypto asset: decentralized exchanges and centralized exchanges. Arbitrum is available to trade at Binance, Coinbase, HTX, Kucoin, MEXC Global, OKX, Gate.io, AscendEX, Bybit